|

NEVADA

|

95-4627685

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

Number)

|

|

PAGE

|

||

|

PART

I

|

||

|

Item

1

|

Business

|

1

|

|

Item

2

|

Properties

|

23

|

|

Item

3

|

Legal

Proceedings

|

24

|

|

Item

4

|

Submission

of Matters to a Vote of Security Holders

|

24

|

|

PART

II

|

||

|

Item

5

|

Market

for Common Equity and Related Stockholder Matters and Small Business

Issuer Purchases of Equity Securities

|

25

|

|

Item

6

|

Management's

Discussion and Analysis and Plan of Operations

|

27

|

|

Item

7

|

Financial

Statements

|

38

|

|

Item

8

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

38

|

|

Item

8A

|

Controls

and Procedures

|

38

|

|

PART

III

|

||

|

Item

9

|

Directors,

Executive Officers, Promoters and Control Persons; Corporate Governance;

Compliance with Section 16(a) of the Exchange Act

|

39

|

|

Item

10

|

Executive

Compensation

|

41

|

|

Item

11

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

55

|

|

Item

12

|

Certain

Relationships and Related Transactions

|

56

|

|

PART

IV

|

||

|

Item

13

|

Exhibits

and Reports on Form 8-K

|

57

|

|

Item

14

|

Principal

Accountant Fees and Services

|

59

|

| § |

To

discover, develop, and deploy the talent at

Netsol

|

| § |

To

nurture leadership in people and

processes

|

| § |

To

explore and develop capable backups for positions critical to

organizational continuity

|

| · |

OracleMicrosoft

Gold Partner

|

| · |

IBM

Business Partner

|

| · |

Sun

Microsystems

|

| · |

HP

DSPP Partner

|

| · |

Daimler

Financial Services

|

| · |

Innovation

Group PLC UK

|

| · |

GE

|

| · |

Software

Engineering Institute

|

| · |

Kaspersky

Lab

|

| · |

SAP

|

| · |

Business

Objects

|

| · |

IBM-Internet

Security System

|

| · |

REAL

|

|

2008

|

2007

|

||||||

|

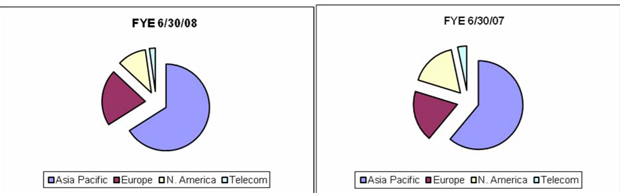

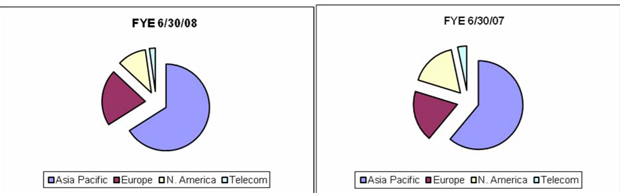

Asia

Pacific Region (NetSol PK, NetSol-Innvation, Abraxas)

|

66.01

|

%

|

61.04

|

%

|

|||

|

Europe

(NTE, UK Ltd.)

|

20.95

|

%

|

18.72

|

%

|

|||

|

North

America (NetSol Technologies, Inc., NTNA)

|

10.83

|

%

|

16.92

|

%

|

|||

|

Telecom

Sector (NetSol Connect)

|

2.21

|

%

|

3.32

|

%

|

|||

|

Total

Revenues

|

100.00

|

%

|

100.00

|

%

|

|||

|

·

|

11

new implementation contracts signed during the

year.

|

|

·

|

Of

these, 7 new contracts signed during the fourth

quarter.

|

|

·

|

New

names in the customer list, including Fiat Automotive Finance, CNH

Capital, and a large automotive blue chip company in

China.

|

|

·

|

The

addition of the Fleet Management System to the LeaseSoft

Suite.

|

|

·

|

In

collaboration with its strategic partner Real Consulting Information

Systems S.A. of Athens, Greece ("Real Consulting S.A."), signed an

agreement with a major European Bank to implement LeaseSoft within

its

growing financial leasing unit. The Bank is an international banking

organization that offers its products and services both through its

network of over 1,500 branches and points of sale and through alternative

distribution channels.

|

|

·

|

Kaupthing

Singer and Friedlander goes live in February 2008 with the full web

based

proposal management and credit underwriting solution, a complete

replacement of the web front end with an NTE

product

|

|

·

|

BNP

Paribas LG NL goes live in May 2008 with

LSA

|

|

·

|

Venture

Finance goes live in December 2007

|

|

·

|

Execution

of a reseller’s agreement for LeaseSoft Asset with a strong software

provider in Africa

|

|

·

|

11

new implementation contracts signed during the

year.

|

|

·

|

Of

these, 7 new contracts signed during the fourth

quarter.

|

|

·

|

New

names in the customer list, including Fiat Automotive Finance, CNH

Capital, and a large automotive blue chip company in

China.

|

|

·

|

The

addition of the Fleet Management System to the LeaseSoft

Suite.

|

| * |

Adding

5 new clients in China in the last 18 months, continuing its status

as the

Company’s biggest single market

|

| * |

A

turnaround in our Australian market adding new names such as CNH

Australia

|

| * |

Launch

of Thailand office

|

| * |

Robust

growth of NetSol’s joint venture with Innovation Group, over 130

programmers dedicated

|

|

*

|

Continued

addition of blue chip customers such as Terex Corp, Fiat, Toyota

Financial, blue chip names in the US and

Investec

|

|

Purpose/Use

|

Monthly

Rental Expense

|

|||||||||

|

Australia.

|

1,140

|

Computer

and General Office

|

$

|

1,380

|

||||||

|

Beijing,

China

|

431

|

General

Office

|

$

|

4,315

|

||||||

|

Burlingame,

CA (NetSol McCue)

|

8,089

|

Computer

and General Office

|

$

|

16,178

|

||||||

|

Emeryville,

CA (NTNA)

|

23,908

|

Computer

and General Office

|

$

|

77,880

|

||||||

|

Horsham,

UK (NetSol Europe)

|

6,570

|

Computer

and General Office

|

$

|

12,528

|

||||||

|

NetSol

PK (Karachi Office)

|

1,883

|

General

Office

|

$

|

1,726

|

||||||

|

NetSol

PK (Islamabad Office)

|

3,240

|

General

Office & Guest House

|

$

|

1,417

|

||||||

|

NetSol

(Rawalpindi Office)

|

6,200

|

General

Office

|

$

|

850

|

||||||

|

Thailand

|

936

|

Computer

and General Office

|

$

|

752

|

||||||

|

Director

|

For

|

|

Withhold

|

|

Percent

of Total Voted

|

|

Total

Shares Voted

|

||||||

|

Najeeb

Ghauri

|

22,530,798

|

381,810

|

98.33

|

22,912,608

|

|||||||||

|

Naeem

Ghauri

|

22,527,198

|

385,410

|

98.31

|

22,912,608

|

|||||||||

|

Salim

Ghauri

|

22,496,507

|

416,101

|

98.18

|

22,912,608

|

|||||||||

|

Shahid

Burki

|

22,338,231

|

574,377

|

97.49

|

22,912,608

|

|||||||||

|

Eugen

Beckert

|

22,339,231

|

574,224

|

97.49

|

22,912,608

|

|||||||||

|

Mark

Caton

|

21,919,409

|

993,199

|

95.66

|

22,912,608

|

|||||||||

|

Alexander

Shakow

|

22,613,565

|

299,043

|

98.69

|

22,912,608

|

|||||||||

|

Total

Shares Voted

|

For

|

|

Against

|

|

Abstain

|

|

Percent

|

||||||

|

22,912,608

|

21,934,373

|

813,922

|

164,311

|

95.73

|

%

|

||||||||

|

Total

Shares Voted

|

For

|

|

Against

|

|

Abstain

|

|

Broker

Non-Vote

|

|

Percent

|

|||||||

|

22,912,608

|

12,282,394

|

1,464,299

|

62,630

|

9,103,285

|

53.60

|

%

|

||||||||||

|

Total

Shares Voted

|

For

|

Against

|

Abstain

|

Broker

Non-Vote

|

Percent

|

|||||||||||

|

22,912,608

|

12,075,501

|

1,518,416

|

214,460

|

9,103,285

|

52.70

|

%

|

||||||||||

|

2007-2008

|

2006-2007

|

||||||||||||

|

Fiscal

|

|||||||||||||

|

Quarter

|

High

|

Low

|

High

|

Low

|

|||||||||

|

1st

(ended September 30)

|

3.19

|

1.41

|

2.00

|

1.27

|

|||||||||

|

2nd

(ended December 31)

|

4.64

|

2.18

|

2.05

|

1.40

|

|||||||||

|

3rd

(ended March 31)

|

2.75

|

1.45

|

2.05

|

1.40

|

|||||||||

|

4th

(ended June 30)

|

3.06

|

1.90

|

2.05

|

1.40

|

|||||||||

|

2007-2008

|

2006-2007

|

||||||||||||

|

Fiscal

|

|||||||||||||

|

Quarter

|

High

|

Low

|

High

|

Low

|

|||||||||

|

1st

(ended September 30)

|

—

|

—

|

—

|

—

|

|||||||||

|

2nd

(ended December 31)

|

—

|

—

|

—

|

—

|

|||||||||

|

3rd

(ended March 31)

|

—

|

—

|

—-

|

—

|

|||||||||

|

4th

(ended June 30)

|

2.94

|

2.67

|

—

|

—

|

|||||||||

|

Number of

securities to

be issued

upon

exercise of

outstanding

options,

warrants

and rights

|

Weighted-average

exercise price of

outstanding

options, warrants

and rights

|

Number of securities

remaining

available for

future issuance

under equity

compensation

plans

(excluding

securities

reflected in

column (a))

|

||||||||

|

Equity Compensation

Plans

approved by

Security

holders

|

8,064,739

|

(1)

|

$

|

2.48

|

(2)

|

4,162,148

|

(3)

|

|||

|

Equity

Compensation

Plans

not approved by

Security

holders

|

None

|

None

|

None

|

|||||||

|

Total

|

8,064,739

|

$

|

2.48

|

4,162,148

|

||||||

|

(1)

|

Consists

of 16,000 under the 2001 Incentive and Nonstatutory Stock Option

Plan;

882,000 under the 2002 Incentive and Nonstatutory Stock Option Plan;

479,000 under the 2003 Incentive and Nonstatutory Stock Option Plan;

3,075,425 under the 2004 Incentive and Nonstatutory Stock Option

Plan; and

1,620,000 under the 2005 Incentive and Nonstatutory Stock Option

Plan.

|

|

(2)

|

The

weighted average of the options is

$2.59.

|

|

(3)

|

Represents

840,394 available for issuance under the 2003 Incentive and Nonstatutory

Stock Option Plan; 51,754 available for issuance under the 2004 Incentive

and Nonstatutory Stock Option Plan; and, 3,270,000 available for

issuance

under the 2005 Incentive and Nonstatutory Stock Option Plan.

|

|

Issuer Purchases of Equity Securities(1)

|

|||||||||||||

|

|

Total Number of Shares

Purchased

|

Average Price Paid per

Share

|

Total Number of shares

Purchased as Part of

Publicly Announced Plans

or Programs

|

Maximum Number of

Shares that may be

Purchase Under the Plans

or Programs

|

|||||||||

|

|

|

|

|

|

|||||||||

|

January

2008

|

-0-

|

$

|

0.00

|

-0-

|

-0-

|

||||||||

|

February

2008

|

-0-

|

$

|

0.00

|

-0-

|

-0-

|

||||||||

|

March

2008

|

13,600

|

$

|

1.87

|

13,600

|

986,400

|

||||||||

|

June

2008

|

-0-

|

$

|

0.00

|

-0-

|

-0-

|

||||||||

| (1) |

On

March 24, 2008, the Company announced that it had authorized a stock

repurchase program permitting the Company to repurchase up to 1,000,000

of

its shares of common stock over the next 6 months. The shares are

to be

repurchased from time to time in open market transactions or privately

negotiated transactions in the Company's

discretion.

|

|

·

|

Expand

sales and marketing activities in China. In addition to the Beijing

office, we anticipate launching new sales and support offices in

at least

1-2 more cities in China.

|

|

·

|

Grow

NetSol in the newest region in the UAE and Gulf states. Initially,

a small

virtual office is being set up in Dubai area that could roll into

a bigger

and stand alone presence in the

area.

|

|

·

|

Globalization

and diversification of development and programming capabilities,

not

limited to Southeast Asia but exploration of emerging economies in

Central

and South America to support the NTNA

business.

|

|

·

|

Most

strategic goal in 2009 is to establish the NTNA business by expanding

the

existing operations. The move from a smaller office in Burlingame

to a

much larger office in Emeryville will be a major event in NetSol

history.

This strategy has strong potential of ramping up global business

and

valuation for Netsol consistent with our stated

vision.

|

|

·

|

Actively

explore both opportunistic and synergistic alliances and partnerships

in

Americas and Europe.

|

|

·

|

Improve

the quality of hiring of senior management personnel in key locations.

Further build a stronger middle management resource pool to deliver

and

execute the growth and earnings envisioned by the management.

|

|

·

|

Introduce

and market two LeaseSoft modules: WSF and CAPS in the US

market.

|

|

·

|

Grow

into new business verticals including healthcare, insurance, and

banking

in the US and European markets. The launch of Global Business Services

through these verticals is an important goal in 2009.

|

|

·

|

Enhance

software design, engineering and service delivery capabilities by

increasing investment in training.

|

|

·

|

Continue

to invest in research and development in an amount between 7-10%

of yearly

budgets in both new developments and domains within NetSol’s core

competencies.

|

|

·

|

NetSol

technology campus to become much more cost efficient, enhanced

productivity and services to global clients and partners.

|

|

·

|

Market

aggressively on a regional basis

the Company’s tri–product solutions by broader marketing efforts for

LeaseSoft in APAC and untapped markets; aggressively grow LeasePak

solutions in North America; and, further establish NetSol Enterprise

solution in the European markets.

|

|

·

|

Broaden

value added investor base in the UAE region and US institutions.

Also

attract technology focused analysts coverage to improve NetSol valuation

and multiples.

|

|

·

|

Prompt

organic expansion in North America market by expanding the sales

and

marketing team.

|

|

·

|

Diversify

in new verticals of services in North America such as insurance,

healthcare, public sectors.

|

|

·

|

Continue

sales momentum and pipeline of LeaseSoft in APAC, Europe and now

in the

Americas.

|

|

·

|

Further

extending services offerings to existing 30 plus US

customers.

|

|

·

|

Penetrate

further into the Chinese market by adding new

locations.

|

|

·

|

Effectively

enter the UAE and regional markets for LeaseSoft and

services.

|

|

·

|

Further

penetrate in Australian market in captive and non-captive

sectors.

|

|

·

|

Fully

leverage NetSol’s reputable name in the UK and European markets within

banking, leasing and insurance

sectors.

|

|

·

|

Encourage

joint ventures and new alliances.

|

|

·

|

Add

breadth and depth to the investor base in the US and UK by aggressively

presenting in various investors forums and analysts

meetings.

|

|

·

|

Grow

further institutional ownership from 20% to 40% by continuously presenting

the Company with a focus on the US /China / UAE business

expansion.

|

|

·

|

IR/PR

to expand media reach in 2009. NetSol has been interviewed by Fox

Business

Network, Nasdaq site and many print publications in

2008.

|

|

·

|

NetSol

management was invited on June 24, 2008 to closing bell at NASDAQ

Stock

Exchange.

|

|

·

|

Expand

the investor ownership in the UAE market to generate increased trading

volumes on the NASDAQ Capital Market and the DIFX

exchanges.

|

|

·

|

Continue

to encourage stock options exercises by officers and employees. Improve

internal cash flows through enhanced process of A/Rs collections

and

explore most strategic investors with value add

perspectives.

|

|

·

|

Make

every effort to enhance NetSol’s market capitalization in the

US.

|

|

·

|

Grow

topline, enhance gross profit margins to 62-65% by leveraging the

low-cost

development facility in Lahore and Best Shoring

model.

|

|

·

|

Generate

much higher revenues per developer and service group, enhance productivity

and lower cost per employee

overall.

|

|

·

|

Consolidate

subsidiaries and integrate and combine entities to reduce overheads

and

employ economies of scale.

|

|

·

|

Continue

to review costs at every level to consolidate and enhance operating

efficiencies.

|

|

·

|

Grow

process automation and leverage the best practices of CMMi level

5.

|

|

·

|

Cost

efficient management of every operation and continue further consolidation

to improve bottom line.

|

|

·

|

Initiated

steps to consolidate some of the new lines of services businesses

to

improve both operating and net margins.

|

|

·

|

Robust

worldwide shift towards cost redundancies, economies of scale and

labor

arbitrage.

|

|

·

|

The

global economic pressures has shifted IT processes and technology

to

utilize both offshore and onshore solutions providers, to control

the

costs and improve ROIs.

|

|

·

|

New

trends in the most emerging and newest markets. There has been a

noticeable new demand of leasing and financing solutions as a result

of

new buying habits and patterns in the Middle East, Eastern Europe

and

Central America.

|

|

·

|

The

overall leasing and finance industry in North America has steadily

grown

to over $260 billion despite the subprime crises, partly due to the

resulting lack of cash liquidity.

|

|

·

|

The

levy of Indian IT sector excise tax of 35% (NASSCOM) on software

exports

is very positive for NetSol. In Pakistan there is a 15 year tax holiday

on

IT exports of services. There are 10 more years remaining on this

tax

incentive.

|

|

·

|

Cost

arbitrage, labor costs still very competitive and attractive when

compared

with India. Pakistan is significantly under priced for IT services

and

programmers as compared to India.

|

|

·

|

Pakistan

is one of the fastest growing IT destinations from emerging and new

markets.

|

|

·

|

Chinese

market is burgeoning and wide open for NetSol’s ‘niche’ products and

services. NetSol is gaining a strong foothold in this

market.

|

|

·

|

The

disturbance in Middle East, Afghanistan and Pakistan borders. Due

to 9/11

events and global war on terrorism, the travel advisory of Americans

travel restrictions to Pakistan continue. In addition, travel restrictions

to the US and more stringent immigration laws are causing delays

in travel

to the US.

|

|

·

|

Negative

perception and image created by extremism and terrorism in the South

Asian

region.

|

|

·

|

Overall

slump in world markets, curtailing IT and spending

budgets.

|

|

·

|

Unstable

economic and political environment in Pakistan and the current volatility

of Pakistan’s capital markets.

|

|

·

|

Worry

of an expanding and unending credit crunch in the world economies

due to

financial and banking sector

failures.

|

|

·

|

Overall

decline of auto sales due to higher oil prices and inflationary

pressure.

|

|

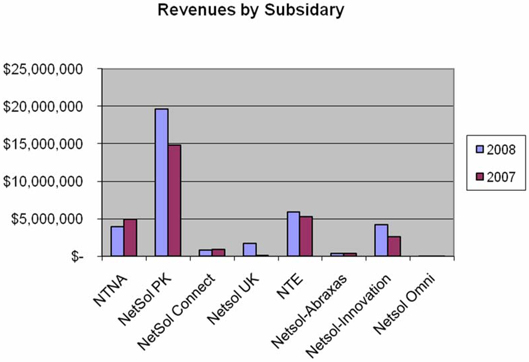

2008

|

2007

|

||||||||||||

|

North

America:

|

|||||||||||||

|

Netsol

Tech NA (NTNA)

|

$

|

3,969,521

|

10.83

|

%

|

$

|

4,953,083

|

16.92

|

%

|

|||||

|

3,969,521

|

10.83

|

%

|

4,953,083

|

16.92

|

%

|

||||||||

|

Europe:

|

|||||||||||||

|

Netsol

UK

|

1,767,564

|

4.82

|

%

|

138,656

|

0.47

|

%

|

|||||||

|

Netsol

Tech Europe (NTE)

|

5,908,661

|

16.13

|

%

|

5,344,316

|

18.25

|

%

|

|||||||

|

7,676,225

|

20.95

|

%

|

5,482,972

|

18.72

|

%

|

||||||||

|

Asia-Pacific:

|

|||||||||||||

|

NetSol

PK

|

19,610,797

|

53.52

|

%

|

14,796,001

|

50.53

|

%

|

|||||||

|

Netsol-Innovation

|

4,199,520

|

11.46

|

%

|

2,622,318

|

8.96

|

%

|

|||||||

|

Netsol

Connect

|

811,232

|

2.21

|

%

|

972,095

|

3.32

|

%

|

|||||||

|

Netsol-Omni

|

30,366

|

0.08

|

%

|

44,151

|

0.15

|

%

|

|||||||

|

Netsol-Abraxas

Australia

|

344,514

|

0.94

|

%

|

411,466

|

1.41

|

%

|

|||||||

|

24,996,429

|

68.22

|

%

|

18,846,031

|

64.36

|

%

|

||||||||

|

Total

Net Revenues

|

$

|

36,642,175

|

100.00

|

%

|

$

|

29,282,086

|

100.00

|

%

|

|||||

|

For

the Year

|

|||||||||||||

|

Ended

June 30,

|

|||||||||||||

|

2008

|

2007

|

||||||||||||

|

%

|

%

|

||||||||||||

|

Net

Revenues:

|

|

||||||||||||

|

License

fees

|

$

|

12,685,039

|

34.62

|

%

|

$

|

9,788,266

|

33.43

|

%

|

|||||

|

Maintenance

fees

|

6,306,321

|

17.21

|

%

|

5,441,339

|

18.58

|

%

|

|||||||

|

Services

|

17,650,815

|

48.17

|

%

|

14,052,481

|

47.99

|

%

|

|||||||

|

Total

revenues

|

36,642,175

|

100.00

|

%

|

29,282,086

|

100.00

|

%

|

|||||||

|

Cost

of revenues

|

|||||||||||||

|

Salaries

and consultants

|

10,071,664

|

27.49

|

%

|

8,812,934

|

30.10

|

%

|

|||||||

|

Travel

|

1,719,743

|

4.69

|

%

|

1,529,796

|

5.22

|

%

|

|||||||

|

Repairs

and maintenance

|

405,140

|

1.11

|

%

|

430,962

|

1.47

|

%

|

|||||||

|

Insurance

|

239,043

|

0.65

|

%

|

211,897

|

0.72

|

%

|

|||||||

|

Depreciation

and amortization

|

1,398,454

|

3.82

|

%

|

794,482

|

2.71

|

%

|

|||||||

|

Other

|

1,890,100

|

5.16

|

%

|

1,914,440

|

6.54

|

%

|

|||||||

|

Total

cost of sales

|

15,724,144

|

42.91

|

%

|

13,694,511

|

46.77

|

%

|

|||||||

|

Gross

profit

|

20,918,031

|

57.09

|

%

|

15,587,575

|

53.23

|

%

|

|||||||

|

Operating

expenses:

|

|||||||||||||

|

Selling

and marketing

|

3,722,470

|

10.16

|

%

|

3,161,924

|

10.80

|

%

|

|||||||

|

Depreciation

and amortization

|

1,939,502

|

5.29

|

%

|

1,846,790

|

6.31

|

%

|

|||||||

|

Bad

debt expense

|

58,293

|

0.16

|

%

|

189,873

|

0.65

|

%

|

|||||||

|

Salaries

and wages

|

3,703,836

|

10.11

|

%

|

3,696,501

|

12.62

|

%

|

|||||||

|

Professional

services, including non-cash compensation

|

837,598

|

2.29

|

%

|

1,067,702

|

3.65

|

%

|

|||||||

|

General

and adminstrative

|

3,447,113

|

9.41

|

%

|

2,977,917

|

10.17

|

%

|

|||||||

|

Total

operating expenses

|

13,708,812

|

37.41

|

%

|

12,940,707

|

44.19

|

%

|

|||||||

|

Income

from operations

|

7,209,219

|

19.67

|

%

|

2,646,868

|

9.04

|

%

|

|||||||

|

Other

income and (expenses):

|

|||||||||||||

|

Gain

(loss) on sale of assets

|

(35,484

|

)

|

-0.10

|

%

|

(2,977

|

)

|

-0.01

|

%

|

|||||

|

Beneficial

conversion feature

|

-

|

0.00

|

%

|

(2,208,334

|

)

|

-7.54

|

%

|

||||||

|

Amortization

of debt discount and capitalized cost of debt

|

-

|

0.00

|

%

|

(2,803,691

|

)

|

-9.57

|

%

|

||||||

|

Liquidation

damages

|

-

|

0.00

|

%

|

(180,890

|

)

|

-0.62

|

%

|

||||||

|

Fair

market value of warrants issued

|

-

|

0.00

|

%

|

(68,411

|

)

|

-0.23

|

%

|

||||||

|

Interest

expense

|

(626,708

|

)

|

-1.71

|

%

|

(617,818

|

)

|

-2.11

|

%

|

|||||

|

Interest

income

|

195,103

|

0.53

|

%

|

339,164

|

1.16

|

%

|

|||||||

|

Gain

on sale of subsidiary shares

|

1,240,808

|

3.39

|

%

|

-

|

0.00

|

%

|

|||||||

|

Other

income and (expenses)

|

2,169,383

|

5.92

|

%

|

114,423

|

0.39

|

%

|

|||||||

|

Total

other income (expenses)

|

2,943,102

|

8.03

|

%

|

(5,428,534

|

)

|

-18.54

|

%

|

||||||

|

Net

income (loss) before minority interest in

subsidiary

|

10,152,321

|

27.71

|

%

|

(2,781,666

|

)

|

-9.50

|

%

|

||||||

|

Minority

interest in subsidiary

|

(5,038,115

|

)

|

-13.75

|

%

|

(2,832,985

|

)

|

-9.67

|

%

|

|||||

|

Income

taxes

|

(121,982

|

)

|

-0.33

|

%

|

(160,306

|

)

|

-0.55

|

%

|

|||||

|

Net

income (loss)

|

4,992,224

|

13.62

|

%

|

(5,774,957

|

)

|

-19.72

|

%

|

||||||

|

Dividend

required for preferred stockholders

|

(178,541

|

)

|

-0.49

|

%

|

(237,326

|

)

|

-0.81

|

%

|

|||||

|

Net

income (loss) applicable to common

shareholders

|

4,813,683

|

13.14

|

%

|

(6,012,283

|

)

|

-20.53

|

%

|

||||||

|

2008

|

2007

|

||||||||||||

|

North

America:

|

|||||||||||||

|

NetSol

- North America (NTNA)

|

$

|

816,455

|

7.76

|

%

|

$

|

1,693,383

|

19.74

|

%

|

|||||

|

816,455

|

7.76

|

%

|

1,693,383

|

19.74

|

%

|

||||||||

|

Europe:

|

|||||||||||||

|

NetSol

UK

|

1,119,663

|

10.65

|

%

|

44,052

|

0.51

|

%

|

|||||||

|

NetSol

- Europe (NTE)

|

1,283,964

|

12.21

|

%

|

1,341,162

|

15.64

|

%

|

|||||||

|

2,403,627

|

22.86

|

%

|

1,385,214

|

16.15

|

%

|

||||||||

|

Asia-Pacific:

|

|||||||||||||

|

NetSol

PK

|

5,766,036

|

54.83

|

%

|

4,307,370

|

50.22

|

%

|

|||||||

|

NetSol-Innovation

|

1,259,374

|

11.98

|

%

|

232,261

|

2.71

|

%

|

|||||||

|

NetSol

Connect

|

194,846

|

1.85

|

%

|

918,336

|

10.71

|

%

|

|||||||

|

NetSol-Omni

|

-

|

0.00

|

%

|

167

|

0.00

|

%

|

|||||||

|

NetSol-Abraxas

Australia

|

75,317

|

0.72

|

%

|

39,708

|

0.46

|

%

|

|||||||

|

Totals

|

7,295,573

|

69.38

|

%

|

5,497,842

|

64.10

|

%

|

|||||||

|

Total

Net Revenues

|

$

|

10,515,655

|

100.00

|

%

|

$

|

8,576,439

|

100.00

|

%

|

|||||

|

For

the Three Months Ended

|

|||||||||||||

|

June 30, 2008

|

June 30, 2007

|

||||||||||||

|

|

% of sales

|

% of sales

|

|||||||||||

|

Revenues:

|

|||||||||||||

|

License

fees

|

$

|

4,915,813

|

46.75

|

%

|

$

|

2,936,770

|

34.24

|

%

|

|||||

|

Maintenance

fees

|

1,749,871

|

16.64

|

%

|

1,451,243

|

16.92

|

%

|

|||||||

|

Services

|

3,849,971

|

36.61

|

%

|

4,188,426

|

48.84

|

%

|

|||||||

|

Total

revenues

|

10,515,655

|

100.00

|

%

|

8,576,439

|

100.00

|

%

|

|||||||

|

Cost

of revenues:

|

|||||||||||||

|

Salaries

and consultants

|

2,728,921

|

25.95

|

%

|

2,204,328

|

25.70

|

%

|

|||||||

|

Depreciation

and amortization

|

551,166

|

5.24

|

%

|

60,404

|

0.70

|

%

|

|||||||

|

Travel,

communication, and other

|

1,453,307

|

13.82

|

%

|

985,568

|

11.49

|

%

|

|||||||

|

Total

cost of sales

|

4,733,394

|

45.01

|

%

|

3,250,300

|

37.90

|

%

|

|||||||

|

Gross

profit

|

5,782,261

|

54.99

|

%

|

5,326,139

|

62.10

|

%

|

|||||||

|

Operating

expenses:

|

|||||||||||||

|

Selling

and marketing

|

904,562

|

8.60

|

%

|

811,328

|

9.46

|

%

|

|||||||

|

Depreciation

and amortization

|

517,321

|

4.92

|

%

|

497,461

|

5.80

|

%

|

|||||||

|

Salaries

and wages

|

945,402

|

8.99

|

%

|

895,610

|

10.44

|

%

|

|||||||

|

Professional

services

|

413,490

|

3.93

|

%

|

293,499

|

3.42

|

%

|

|||||||

|

Bad

debt expense

|

55,016

|

0.52

|

%

|

72,606

|

0.85

|

%

|

|||||||

|

General

and adminstrative

|

1,170,091

|

11.13

|

%

|

866,220

|

10.10

|

%

|

|||||||

|

Total

operating expenses

|

4,005,882

|

38.09

|

%

|

3,436,724

|

40.07

|

%

|

|||||||

|

Income

(loss) from operations

|

1,776,379

|

16.89

|

%

|

1,889,415

|

22.03

|

%

|

|||||||

|

Other

income and (expenses)

|

|||||||||||||

|

Gain/(Loss)

on sale of assets

|

(2,440

|

)

|

-0.02

|

%

|

16,090

|

0.19

|

%

|

||||||

|

Fair

market value of warrants issued

|

-

|

0.00

|

%

|

(34,424

|

)

|

-0.40

|

%

|

||||||

|

Interest

expense

|

(82,043

|

)

|

-0.78

|

%

|

(74,476

|

)

|

-0.87

|

%

|

|||||

|

Interest

income

|

35,234

|

0.34

|

%

|

73,248

|

0.85

|

%

|

|||||||

|

Other

income and (expenses)

|

1,460,269

|

13.89

|

%

|

25,488

|

0.30

|

%

|

|||||||

|

Income

taxes

|

(75,710

|

)

|

-0.72

|

%

|

(33,686

|

)

|

-0.39

|

%

|

|||||

|

Total

other expenses

|

1,335,310

|

12.70

|

%

|

(27,760

|

)

|

-0.32

|

%

|

||||||

|

Net

income (loss) before minority interest in

subsidiary

|

3,111,689

|

29.59

|

%

|

1,861,655

|

21.71

|

%

|

|||||||

|

Minority

interests in earnings of subsidiary

|

(1,749,625

|

)

|

-16.64

|

%

|

(1,077,828

|

)

|

-12.57

|

%

|

|||||

|

Net

income (loss)

|

1,362,064

|

12.95

|

%

|

783,827

|

9.14

|

%

|

|||||||

|

Dividend

required for preferred stockholders

|

(33,508

|

)

|

-0.32

|

%

|

(77,640

|

)

|

-0.91

|

%

|

|||||

|

Net

income (loss) applicable to common

shareholders

|

1,328,556

|

12.63

|

%

|

706,187

|

8.23

|

%

|

|||||||

|

Net

income (loss) per share:

|

|||||||||||||

|

Basic

|

$

|

0.05

|

$

|

0.04

|

|||||||||

|

Diluted

|

$

|

0.05

|

$

|

0.04

|

|||||||||

|

Weighted

average number of shares outstanding

|

|||||||||||||

|

Basic

|

25,425,042

|

19,706,920

|

|||||||||||

|

Diluted

|

27,303,554

|

19,835,177

|

|||||||||||

|

·

|

Working

capital of $5.0 to $7.0 million for US, European and Pakistan business

expansion, new business development activities and infrastructure

enhancements.

|

|

·

|

Stock

volatility due to market conditions in general and NetSol stock

performance in particular. This may cause a shift in our approach

to

raising new capital through other sources such as secured long term

debt.

|

|

·

|

Analysis

of the cost of raising capital in the U.S., Europe or emerging markets.

By

way of example only, if the cost of raising capital is high in one

market

and it may negatively affect the company’s stock performance, we may

explore options available in other markets.

|

|

Name

|

Year First Elected

As an Officer or Director

|

Age

|

Position Held with the

Registrant

|

Family Relationship

|

||||

|

Najeeb Ghauri

|

1997

|

53

|

Director

and Chairman

|

Brother

to Naeem and Salim Ghauri

|

||||

|

Salim

Ghauri

|

1999

|

52

|

President

and Director

|

Brother

to Naeem and Najeeb Ghauri

|

||||

|

Naeem

Ghauri

|

1999

|

50

|

Chief

Executive Officer, Director

|

Brother

to Najeeb and Salim Ghauri

|

||||

|

Tina

Gilger

|

2005

|

46

|

Chief

Financial Officer

|

None

|

||||

|

Patti

L. W. McGlasson

|

2004

|

43

|

Secretary,

General Counsel

|

None

|

||||

|

Shahid

Javed Burki

|

2000

|

69

|

Director

|

None

|

||||

|

Eugen

Beckert

|

2001

|

60

|

Director

|

None

|

||||

|

Mark

Caton

|

2002

|

58

|

Director

|

None

|

||||

|

Alexander

Shakow

|

2007

|

70

|

Director

|

None

|

|

Name and Principle

Position

|

Fiscal Year

Ended

|

Salary ($)

|

Bonus

($)

|

Stock

Awards ($)

(1)

|

Option

Awards ($)

|

All Other

Compensation

($)

|

Total ($)

|

|||||||||||||||

|

Najeeb

Ghauri

Chief

Executive Officer,

Chairman

|

2008

2007

|

$

$

|

287,500

275,000

|

$

$

|

-

50,000

|

$

$

|

-

-

|

$

$

|

-

-

|

(2)

(2)

|

$

$

|

51,701

46,700

|

(3)

(3)

|

$

$

|

339,201

371,700

|

|||||||

|

Naeem

Ghauri

Chief

Executive Officer,

Global

Products Division

|

2008

2007

|

$

$

|

235,183

220,282

|

$

$

|

-

50,000

|

$

$

|

-

-

|

$

$

|

-

-

|

(2)

(3)

|

$

$

|

37,906

34,660

|

(4)

(4)

|

$

$

|

273,089

304,942

|

|||||||

|

Salim

Ghauri

Chief

Executive Officer,

Global

Services Division

|

2008

2007

|

$

$

|

200,000

175,000

|

$

$

|

-

50,000

|

$

$

|

-

-

|

$

$

|

-

-

|

(2)

(2)

|

$

$

|

-

-

|

(5)

(5)

|

$

$

|

200,000

225,000

|

|||||||

|

Tina

Gilger

Chief

Financial Officer

|

2008

2007

|

$

$

|

128,917

95,000

|

$

$

|

15,000

7,004

|

$

$

|

-

-

|

$

$

|

12,160

-

|

(2)

(2)

|

$

$

|

12,846

17,587

|

(6)

(6)

|

$

$

|

168,923

119,591

|

|||||||

|

Patti

L. W. McGlasson

Secretary,

General

Counsel

|

2008

2007

|

$

$

|

128,333

110,000

|

$

$

|

5,000

6,536

|

$

$

|

-

-

|

$

$

|

12,160

-

|

(2)

(2)

|

$

$

|

-

-

|

(7)

(7)

|

$

$

|

145,493

116,536

|

|||||||

|

NAME

|

NUMBER OF

SECURITIES

UNDERLYING

OPTIONS (#)

EXERCISABLE

|

NUMBER OF

SECURITIES

UNDERLYING

OPTIONS (#)

UNEXERCISABLE

|

OPTION

EXERCISE

PRICE ($)

|

OPTION

EXPIRATION

DATE

|

|||||||||

|

Najeeb Ghauri

|

100,000

|

-

|

2.21

|

1/1/14

|

|||||||||

|

100,000

|

3.75

|

1/1/14

|

|||||||||||

|

50,000

|

5.00

|

1/1/14

|

|||||||||||

|

20,000

|

2.64

|

3/26/14

|

|||||||||||

|

30,000

|

5.00

|

3/26/14

|

|||||||||||

|

374,227

|

1.94

|

4/1/15

|

|||||||||||

|

500,000

|

2.91

|

4/1/15

|

|||||||||||

|

200,000

|

1.83

|

6/2/16

|

|||||||||||

|

250,000

|

2.50

|

6/2/16

|

|||||||||||

|

Naeem

Ghauri

|

100,000

|

-

|

2.21

|

1/2/14

|

|||||||||

|

100,000

|

3.75

|

1/2/14

|

|||||||||||

|

50,000

|

5.00

|

1/2/14

|

|||||||||||

|

20,000

|

2.64

|

3/26/14

|

|||||||||||

|

30,000

|

5.00

|

3/26/14

|

|||||||||||

|

10,000

|

2.50

|

2/16/12

|

|||||||||||

|

374,227

|

1.94

|

4/1/15

|

|||||||||||

|

500,000

|

2.91

|

4/1/15

|

|||||||||||

|

250,000

|

1.83

|

6/2/16

|

|||||||||||

|

250,000

|

2.50

|

6/2/16

|

|||||||||||

|

Salim

Ghauri

|

100,000

|

-

|

2.21

|

1/2/14

|

|||||||||

|

100,000

|

3.75

|

1/2/14

|

|||||||||||

|

50,000

|

5.00

|

3/26/14

|

|||||||||||

|

20,000

|

2.64

|

3/26/14

|

|||||||||||

|

30,000

|

5.00

|

3/26/14

|

|||||||||||

|

20,000

|

2.50

|

2/16/12

|

|||||||||||

|

374,227

|

1.94

|

4/1/15

|

|||||||||||

|

500,000

|

2.91

|

4/1/15

|

|||||||||||

|

250,000

|

1.83

|

6/2/16

|

|||||||||||

|

250,000

|

2.50

|

6/2/16

|

|||||||||||

|

Tina

Gilger

|

10,000

|

-

|

1.86

|

7/20/15

|

|||||||||

|

10,000

|

2.79

|

7/20/15

|

|||||||||||

|

20,000

|

1.65

|

7/7/15

|

|||||||||||

|

20,000

|

2.25

|

7/7/15

|

|||||||||||

|

10,000

|

1.60

|

7/23/17

|

|||||||||||

|

Patti

L. W. McGlasson

|

10,000

|

-

|

3.00

|

1/1/14

|

|||||||||

|

20,000

|

2.64

|

3/26/14

|

|||||||||||

|

30,000

|

5.00

|

3/26/14

|

|||||||||||

|

20,000

|

1.65

|

7/7/15

|

|||||||||||

|

20,000

|

2.25

|

7/7/15

|

|||||||||||

|

10,000

|

1.60

|

7/23/17

|

|||||||||||

|

BENEFITS

AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||

|

Base

Salary

|

$

|

900,000

|

$

|

-

|

$

|

953,103

|

||||

|

Bonus

|

-

|

|||||||||

|

Salary

Multiple Pay-out

|

897,000

|

|||||||||

|

Bonus

or Revenue One-time Pay-Out

|

366,422

|

|||||||||

|

Net

Cash Value of Options

|

4,190,506

|

|||||||||

|

Total

|

$

|

6,353,928

|

$

|

-

|

$

|

953,103

|

||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||

|

Base

Salary

|

$

|

735,000

|

$

|

-

|

$

|

735,000

|

||||

|

Bonus

|

-

|

|||||||||

|

Salary

Multiple Pay-out

|

732,550

|

|||||||||

|

Bonus

or Revenue One-time Pay-Out

|

366,422

|

|||||||||

|

Net

Cash Value of Options

|

4,371,106

|

|||||||||

|

Total

|

$

|

6,205,078

|

$

|

-

|

$

|

735,000

|

||||

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

||||||||

|

Base

Salary

|

$

|

675,000

|

$

|

-

|

$

|

675,000

|

||||

|

Bonus

|

-

|

|||||||||

|

Salary

Multiple Pay-out

|

672,750

|

|||||||||

|

Bonus

or Revenue One-time Pay-Out

|

366,422

|

|||||||||

|

Net

Cash Value of Options

|

4,371,106

|

|||||||||

|

Total

|

$

|

6,085,278

|

$

|

-

|

$

|

675,000

|

||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||

|

Base

Salary

|

$

|

66,000

|

$

|

-

|

$

|

66,000

|

||||

|

Bonus

|

15,000

|

|||||||||

|

Salary

Multiple Pay-out

|

197,340

|

|||||||||

|

Bonus

or Revenue One-time Pay-Out

|

91,605

|

|||||||||

|

Net

Cash Value of Options

|

180,600

|

|||||||||

|

Total

|

$

|

550,545

|

$

|

-

|

$

|

66,000

|

||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||

|

Base

Salary

|

$

|

130,000

|

$

|

-

|

$

|

130,000

|

||||

|

Bonus

|

5,000

|

|||||||||

|

Salary

Multiple Pay-out

|

388,700

|

|||||||||

|

Bonus

or Revenue One-time Pay-Out

|

183,211

|

|||||||||

|

Net

Cash Value of Options

|

283,800

|

|||||||||

|

Total

|

$

|

990,711

|

$

|

-

|

$

|

130,000

|

||||

|

NAME

|

FEES

EARNED

OR PAID

IN CASH ($)

|

OPTION

AWARDS

($) (1)

|

TOTAL

($)

|

|||||||

|

Eugen Beckert

|

23,000

|

-

|

23,000

|

|||||||

|

Shahid

Javed Burki

|

29,000

|

-

|

29,000

|

|||||||

|

Mark

Caton

|

26,000

|

-

|

26,000

|

|||||||

|

Alexander

Shakow

|

16,000

|

-

|

16,000

|

|||||||

|

BOARD ACTIVITY

|

CASH

PAYMENTS

|

|||

|

Annual

Cash Retainer

|

$

|

10,000

|

||

|

Committee

Membership

|

$

|

2,000

|

||

|

Chairperson

for Audit Committee

|

$

|

15,000

|

||

|

Chairperson

for Compensation Committee

|

$

|

12,000

|

||

|

Chairperson

for Nominating and Corporate Governance Committee

|

$

|

9,000

|

||

|

Name and Address

|

Number of

Shares(1)(2)

|

Percentage

Beneficially

owned(4)

|

|||||

|

Najeeb

Ghauri (3)

|

2,577,650

|

9.75

|

%

|

||||

|

Naeem

Ghauri (3)

|

2,261,367

|

8.56

|

%

|

||||

|

Salim

Ghauri (3)

|

2,434,406

|

9.21

|

%

|

||||

|

Eugen

Beckert (3)

|

223,900

|

*

|

|||||

|

Shahid

Javed Burki (3)

|

194,000

|

*

|

|||||

|

Mark

Caton (3)

|

6,000

|

*

|

|||||

|

Alexander

Shakow (3)

|

0

|

*

|

|||||

|

Patti

McGlasson (3)

|

135,000

|

*

|

|||||

|

Tina

Gilger (3)

|

81,731

|

*

|

|||||

|

The

Tail Wind Fund Ltd.(5)(6)

|

2,748,818

|

9.90

|

%

|

||||

|

All

officers and directors

|

|||||||

|

as

a group (nine persons)

|

7,914,054

|

29.95

|

%

|

||||

|

3.1

|

Articles

of Incorporation of Mirage Holdings, Inc., a Nevada corporation,

dated

March 18, 1997,

|

|

|

incorporated

by reference as Exhibit 3.1 to NetSol’s Registration Statement No.

333-28861 filed on

|

||

|

Form

SB-2 filed June 10, 1997.*

|

||

|

3.2

|

Amendment

to Articles of Incorporation dated May 21, 1999, incorporated

by reference

as Exhibit 3.2 to NetSol’s Annual Report for the fiscal year ended June

30, 1999 on Form 10K-SB filed September 28, 1999.*

|

|

|

3.3

|

Amendment

to the Articles of Incorporation of NetSol International, Inc.

dated March

20, 2002 incorporated by reference as Exhibit 3.3 to NetSol’s Annual

Report on Form 10-KSB/A filed on February 2, 2001.*

|

|

|

3.4

|

Amendment

to the Articles of Incorporation of NetSol Technologies, Inc.

dated August

20, 2003 filed as Exhibit A to NetSol’s Definitive Proxy Statement filed

June 27, 2003.*

|

|

|

3.5

|

Amendment

to the Articles of Incorporation of NetSol Technologies, Inc.

dated March

14, 2005 filed as Exhibit 3.0 to NetSol’s quarterly report filed on Form

10-QSB for the period ended March 31, 2005.*

|

|

|

3.6

|

Amendment

to the Articles of Incorporation dated October 18, 2006 filed

as Exhibit

3.5 to NetSol’s Annual Report for the fiscal year ended June 30, 2007 on

Form 10-KSB.*

|

|

|

3.7

|

Amendment

to Articles of Incorporation dated May 12, 2008 (1)*

|

|

|

3.8

|

Bylaws

of Mirage Holdings, Inc., as amended and restated as of November

28, 2000

incorporated by reference as Exhibit 3.3 to NetSol’s Annual Report for the

fiscal year ending in June 30, 2000 on Form 10K-SB/A filed on

February 2,

2001.*

|

|

|

3.9

|

Amendment

to the Bylaws of NetSol Technologies, Inc. dated February 16,

2002

incorporated by reference as Exhibit 3.5 to NetSol’s Registration

Statement filed on Form S-8 filed on March 27, 2002.*

|

|

|

4.1

|

Form

of Common Stock Certificate*

|

|

|

4.2

|

Form

of Warrant*.

|

|

|

4.3

|

Form

of Series A 7% Cumulative Preferred Stock filed as Annex E to

NetSol’s

Definitive Proxy Statement filed September 18, 2006*.

|

|

|

10.1

|

Lease

Agreement for Calabasas executive offices dated December 3, 2003

incorporated by reference as Exhibit 99.1 to NetSol’s Current Report filed

on Form 8-K filed on December 24, 2003.*

|

|

|

10.2

|

Company

Stock Option Plan dated May 18, 1999 incorporated by reference

as Exhibit

10.2 to the Company’s Annual Report for the Fiscal Year Ended June 30,

1999 on Form 10K-SB filed September 28, 1999.*

|

|

|

10.3

|

Company

Stock Option Plan dated April 1, 1997 incorporated by reference

as Exhibit

10.5 to NetSol’s Registration Statement No. 333-28861 on Form SB-2 filed

June 10, 1997*

|

|

|

10.4

|

Company

2003 Incentive and Nonstatutory incorporated by reference as

Exhibit 99.1

to NetSol’s Definitive Proxy Statement filed February 6,

2004.*

|

|

|

10.5

|

Company

2001 Stock Options Plan dated March 27, 2002 incorporated by

reference as

Exhibit 5.1 to NetSol’s Registration Statement on Form S-8 filed on March

27, 2002.*

|

|

|

10.6

|

Company

2008 Equity Incentive Plan incorporated by reference as Annex

A to

NetSol’s Definitive Proxy Statement filed May 28,

2008.*

|

|

|

10.6

|

Frame

Agreement by and between DaimlerChrysler Services AG and NetSol

Technologies dated June 4, 2004 incorporated by reference as

Exhibit 10.13

to NetSol’s Annual Report for the year ended June 30, 2005 on Form 10-KSB

filed on September 15, 2005.*

|

|

|

10.7

|

Share

Purchase Agreement dated as of January 19, 2005 by and between

the Company

and the shareholders of CQ Systems Ltd. incorporated by reference

as

Exhibit 2.1 to NetSol’s Current Report filed on form 8-K on January 25,

2005.*

|

|

|

10.8

|

Stock

Purchase Agreement dated May 6, 2006 by and between the Company,

McCue

Systems, Inc. and the shareholders of McCue Systems, Inc. incorporated

by

reference as Exhibit 2.1 to NetSol’s Current Report filed on form 8-K on

May 8, 2006.*

|

|

|

10.9

|

Employment

Agreement by and between NetSol Technologies, Inc. and Patti

L. W.

McGlasson dated May 1, 2006 incorporated by reference as Exhibit

10.20 to

NetSol’s Annual Report on form 10-KSB dated September 18,

2006.*

|

|

|

10.11.

|

Employment

Agreement by and between the Company and Najeeb Ghauri dated

January 1,

2007 filed as Exhibit 10.11 to the Company’s Annual Report filed on Form

10-KSB for the year ended June 30, 2007.*

|

|

|

10.12

|

Employment

Agreement by and between the Company and Naeem Ghauri dated January

1,

2007 filed as Exhibit 10.11 to the Company’s Annual Report filed on Form

10-KSB for the year ended June 30, 2007.*

|

|

|

10.13

|

Employment

Agreement by and between the Company and Salim Ghauri dated January

1,

2007 filed as Exhibit 10.11 to the Company’s Annual Report filed on Form

10-KSB for the year ended June 30, 2007.*

|

|

|

10.14

|

Employment

Agreement by and between the Company and Tina Gilger dated August

1, 2007

filed as Exhibit 10.11 to the Company’s Annual Report filed on Form 10-KSB

for the year ended June 30, 2007.*

|

|

|

10.15

|

Amendment

to Employment Agreement by and between Company and Najeeb Ghauri

dated

effective January 1,

2007.*

|

|

10.16

|

Amendment

to Employment Agreement by and between Company and Naeem Ghauri

dated

effective January 1, 2007. *

|

|

|

10.17

|

Amendment

to Employment Agreement by and between Company and Salim Ghauri

dated

effective January 1,*

|

|

|

10.18

|

Lease

Agreement by and between McCue Systems, Inc. and Sea Breeze 1

Venture

dated April 29, 2003*.

|

|

|

10.19

|

Amendment

to Lease Agreement by and between McCue Systems, Inc. and Sea

Breeze 1

Venture dated June 25, 2007 filed as Exhibit 10.19 to the Company’s Annual

Report filed on Form 10-KSB for the year ended June 30, 2007.

*

|

|

|

10.20

|

Lease

Agreement by and between NetSol Pvt Limited and Civic Centres

Company

(PVT) Limited dated May 28, 2001 incorporated by this reference

as Exhibit

10.23 to NetSol’s Annual Report on form 10-KSB dated September 18,

2006.*

|

|

|

10.21

|

Lease

Agreement by and between NetSol Pvt Limited and Mrs. Rameeza

Zobairi dated

December 5, 2005 incorporated by this reference as Exhibit 10.24

to

NetSol’s Annual Report on form 10-KSB dated September 18,

2006.*

|

|

|

10.22

|

Lease

Agreement by and between NetSol Pvt Limited and Mr. Nisar Ahmed

dated May

4, 2006 incorporated by this reference as Exhibit 10.25 to NetSol’s Annual

Report on form 10-KSB dated September 18, 2006.*

|

|

|

10.23

|

Lease

Agreement by and between NetSol Technologies, Ltd. and Argyll

Business

Centres Limited dated April 28, 2006 incorporated by this reference

as

Exhibit 10. 26 to NetSol’s Annual Report on form 10-KSB dated September

18, 2006.*

|

|

|

10.24

|

Tenancy

Agreement by and between NetSol Technologies, Ltd. and Beijing

Lucky

Goldstar Building Development Co. Ltd. dated June 26, 2007 filed

as

Exhibit 10.21 to the Company’s Annual Report filed on Form 10-KSB for the

year ended June 30, 2007.*

|

|

|

10.25

|

Company

2005 Stock Option Plan incorporated by reference as Exhibit 99.1

to

NetSol’s Definitive Proxy Statement filed on March 3,

2006.*

|

|

|

10.26

|

Company

2004 Stock Option Plan incorporated by reference as Exhibit 99.1

to

NetSol’s Definitive Proxy Statement filed on February 7,

2005.*

|

|

|

10.27

|

Working

area sublease by and between NetSol Technologies, Ltd. and Toyota

Leasing

(Thailand) Co. Ltd., dated June 21, 2007 filed as Exhibit 10.24

to the

Company’s Annual Report filed on Form 10-KSB for the year ended June

30,

2007.*

|

|

|

10.28

|

Lease

Agreement by and between NetSol Technologies, Inc. and NetSol

Technologies

North America, Inc. and NOP Watergate LLC dated April 3,

2008.*

|

|

|

10.29

|

Lease

Amendment Number Three by and between NetSol Technologies, Inc.

and

Century National Properties, Inc. dated December 12, 2007.

*

|

|

|

10.30

|

Rent

Agreement by and between Mr. Tahir Mehmood Khan and NetSol Technologies

Ltd. Dated January 21, 2008.

*

|

|

1)

|

On

May 1, 2008, the Company filed a current report including its press

release dated April 30, 2008 which announced the results of operations

and

financial conditions for its Pakistani subsidiary, NetSol Technologies,

Ltd. for the quarter ended March 31,

2008.

|

|

2)

|

On

May 13, 2008, the Company filed a current report including its press

release dated May 13, 2008 and Financial Results Presentation dated

May

13, 2008 which announced the results of operations and financial

conditions for the quarter ended March 31,

2008.

|

| (i) |

Approves

the performance by the independent auditors of certain types of service

(principally audit-related and tax), subject to restrictions in some

cases, based on the Committee’s determination that this would not be

likely to impair the independent auditors’ independence from

NetSol;

|

| (ii) |

Requires

that management obtain the specific prior approval of the Audit Committee

for each engagement of the independent auditors to perform other

types of

permitted services; and,

|

| (iii) |

Prohibits

the performance by the independent auditors of certain types of services

due to the likelihood that their independence would be

impaired.

|

|

NetSol

Technologies, Inc.

|

|||

|

Date:

November 18, 2008

|

BY:

|

/S/

NAJEEB GHAURI

|

|

|

Najeeb

Ghauri

|

|||

|

Chief

Executive Officer

|

|||

|

Date:

November 18, 2008

|

BY:

|

/S/

Tina Gilger

|

|

|

Tina

Gilger

|

|||

|

Chief

Financial Officer

|

|||

|

BY:

|

/S/

NAJEEB U. GHAURI

|

||

|

Najeeb

U. Ghauri

|

|||

|

Chief

Executive Officer

|

|||

|

Director,

Chairman

|

|||

|

Date:

November 18, 2008

|

/S/

SALIM GHAURI

|

||

|

Salim

Ghauri

|

|||

|

President,

APAC

|

|||

|

Director

|

|||

|

Date:

November 18, 2008

|

BY:

|

/S/

NAEEM GHAURI

|

|

|

Naeem

Ghauri

|

|||

|

President,

EMEA

|

|||

|

Director

|

|||

|

Date:

November 10, 2008

|

BY:

|

/S/

EUGEN BECKERT

|

|

|

Eugen

Beckert

|

|||

|

Director

|

|||

|

Date:

November 18, 2008

|

BY:

|

/S/

SHAHID JAVED BURKI

|

|

|

Shahid

Javed Burki

|

|||

|

Director

|

|||

|

Date:

November 18, 2008

|

BY:

|

/S/

MARK CATON

|

|

|

Mark

Caton

|

|||

|

Director

|

|||

|

Date:

November 18, 2008

|

BY:

|

/S/

ALEXANDER SHAKOW

|

|

|

Alexander

Shakow

|

|||

|

Director

|

|

Page

|

||

|

Report

of Independent Registered Public Accounting Firm

|

F-2

|

|

|

Consolidated

Balance Sheets as of June 30, 2008, 2007, and 2006

(restated)

|

F-3

|

|

|

Consolidated

Statements of Operations for the Years Ended June 30, 2008, 2007,

and 2006

(restated)

|

F-4

|

|

|

Consolidated