|

|

|

NEVADA

|

95-4627685

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

Number)

|

|

Large

Accelerated Filer ¨

|

Accelerated

Filer ¨

|

|

Non-accelerated

Filer ¨

|

Smaller

reporting company x

|

|

(Do

not check if a smaller reporting company)

|

|

PAGE

|

||

|

PART

I

|

||

|

Item

1

|

Business

|

1

|

|

Item

2

|

Properties

|

23

|

|

Item

3

|

Legal

Proceedings

|

23

|

|

PART

II

|

||

|

Item

4

|

Market

for Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

|

24

|

|

Item

5

|

Selected

Financial Data

|

25

|

|

Item

6

|

Management's

Discussion and Analysis and Plan of Operations

|

26

|

|

Item

6A

|

Quantitative

and Qualitative Disclosures about Market Risk

|

40

|

|

Item

7

|

Financial

Statements and Supplementary Data

|

40

|

|

Item

8

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

40

|

|

Item

8A(T)

|

Controls

and Procedures

|

40

|

|

Item

8B

|

Other

Information

|

41

|

|

PART

III

|

||

|

Item

9

|

Directors,

Executive Officers and Corporate Governance

|

41

|

|

Item

10

|

Executive

Compensation

|

45

|

|

Item

11

|

Security

Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters

|

59

|

|

Item

12

|

Certain

Relationships and Related Transactions, and Director

Independence

|

60

|

|

Item

13

|

Principal

Accountant Fees and Services

|

60

|

|

PART

IV

|

||

|

Item

14

|

Exhibits

and Financial Statement Schedules

|

62

|

|

|

·

|

SAP

R/3 System deployments

|

|

|

·

|

NetWeaver

|

|

|

·

|

Exchange

Infrastructure Portals

|

|

|

·

|

MySAP

Business Suite

|

|

|

·

|

Supplier

Relationship Management Module

|

|

|

·

|

Client

Relationship Management Module

|

|

|

·

|

SAP/Business

Objects Products and related

Services

|

|

|

§

|

To

discover, develop, and deploy the talent at

NetSol

|

|

|

§

|

To

nurture leadership in people and

processes

|

|

|

§

|

To

explore and develop capable backups for positions critical to

organizational continuity

|

|

|

·

|

SAP

R/3 System deployments

|

|

|

·

|

NetWeaver

|

|

|

·

|

Exchange

Infrastructure Portals

|

|

|

·

|

MySAP

Business Suite

|

|

|

·

|

Supplier

Relationship Management Module

|

|

|

·

|

Client

Relationship Management Module

|

|

|

·

|

SAP/Business

Objects Products and related

Services

|

|

·

|

Oracle

Microsoft Gold Partner

|

|

·

|

IBM

Business Partner

|

|

·

|

Sun

Microsystems

|

|

·

|

HP

DSPP Partner

|

|

·

|

Daimler

Financial Services

|

|

·

|

Innovation

Group PLC UK

|

|

·

|

GE

|

|

·

|

Software

Engineering Institute

|

|

·

|

Kaspersky

Lab

|

|

·

|

SAP

|

|

·

|

Business

Objects

|

|

·

|

IBM-Internet

Security System

|

|

·

|

REAL

Consulting

|

|

·

|

Intel

Solutions Blueprint

|

|

|

|

2010

|

2009

|

|||||||

|

Asia

Pacific Region (NetSol PK, NetSol-Innovation, Connect,

Thailand, Abraxas)

|

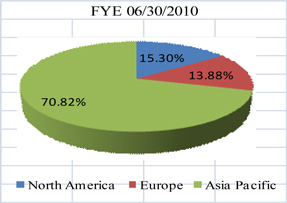

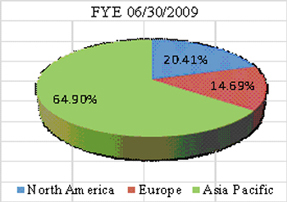

70.82 | % | 64.90 | % | ||||

|

Europe

(NTE, UK Ltd.)

|

13.88 | % | 14.69 | % | ||||

|

North

America (NetSol Technologies, Inc., NTNA)

|

15.30 | % | 20.41 | % | ||||

|

Total

Revenues

|

100.00 | % | 100.00 | % | ||||

|

|

·

|

10

new implementation contracts signed during the

year.

|

|

|

·

|

New

names in the customer list also include Minsheng Bank, China, Volvo

Automotive Finance China, SANY Corporation China, GMAC China and

GAC-Sofinco China.

|

|

|

·

|

Delivery

of a rapid implementation solution of the LeaseSoft product to Aldemore

Bank plc, a private equity backed new UK bank focused on servicing the UK

SME market with a wide range of financial

solutions

|

|

|

·

|

Went

live at Centanary Rural Development Bank in Uganda with our Evolve

product, this being the first live client of the collaboration between NTE

and Neptune Software plc in the African

region.

|

|

|

·

|

Implemented

the Contract Management System with a major bank in

Thailand.

|

|

|

·

|

Implemented

the Wholesale Finance System with Channel Finance in the

Netherlands.

|

|

●

|

Armed

Forces Institute of Cardiology (AFIC) with

HMIS

|

|

●

|

State

Bank e-CIB Project renewal

|

|

●

|

Grievance

Management System for the Prime Minister

Secretariat

|

|

●

|

Khyber-Pakhtoonkhwa

(KPK) Transport Departments Management

System

|

|

●

|

Khyber-Pakhtoonkhwa

(KPK) Legislative & Assembly

Automation

|

|

•

|

Executing

a successful joint venture agreement with Atheeb

Group

|

|

•

|

Further

expansion in the China market by adding new

customers

|

|

•

|

Certification

of our smartOCI™ by SAP for integration into SAP

applications

|

|

•

|

First

Chinese Bank customer, Minsheng Bank

Corp.

|

|

|

•

|

Recertification

of CMMi Level 5 accreditation by the successful completion of an audit

commenced in the 4th

quarter by Carnegie Mellon University certified

consultants.

|

|

|

•

|

Completely

restructured the management and infrastructure of

NTNA

|

|

|

•

|

Launched

NetSol Thai, a new subsidiary in

Thailand

|

|

|

•

|

Globally

integrated the delivery capabilities with NetSol PK, while streamlining

and securing the data in UK location as an emergency response

plan.

|

|

Location/Approximate

|

Square

Feet

|

Purpose/Use

|

Monthly

Rental Expense

|

||||||

|

Alameda,

CA

|

4,298 |

Computer

& General Office

|

$ | 6,876 | |||||

|

Beijing,

China

|

1,413 |

General

Office

|

$ | 4,210 | |||||

|

Horsham,

UK (NetSol Europe)

|

6,570 |

Computer

and General Office

|

$ | 12,528 | |||||

|

NetSol

PK (Karachi Office)

|

1,883 |

General

Office

|

$ | 1,474 | |||||

|

NetSol

PK (Islamabad Office)

|

4,502 |

General

Office & Guest House

|

$ | 2,513 | |||||

|

Bangkok,

Thailand

|

634 |

Computer

and General Office

|

$ | 2,610 | |||||

|

2009-2010

|

2008-2009

|

|||||||||||||||

|

Fiscal

|

||||||||||||||||

|

Quarter

|

High

|

Low

|

High

|

Low

|

||||||||||||

|

1st

(ended September 30)

|

1.17 | .56 | 3.40 | 1.70 | ||||||||||||

|

2nd

(ended December 31)

|

1.23 | .75 | 1.86 | .57 | ||||||||||||

|

3rd

(ended March 31)

|

1.09 | .80 | 1.08 | .22 | ||||||||||||

|

4th

(ended June 30)

|

.95 | .70 | .75 | .29 | ||||||||||||

|

Number of

securities to

be issued

upon

exercise of

outstanding

options,

warrants

and rights

|

Weighted-average

exercise price of

outstanding

options, warrants

and rights

|

Number of securities

remaining

available for

future issuance

under equity

compensation

plans

(excluding

securities

reflected in

column (a)

|

||||||||||

|

Equity

Compensation

Plans

approved by

Security

holders

|

12,470,236 | (1) | $ | 1.54 | (2) | 1,869,413 | (3) | |||||

|

Equity

Compensation

Plans

not approved by

Security

holders

|

None

|

None

|

None

|

|||||||||

|

Total

|

12,470,236 | $ | 1.54 | 1,869,413 | ||||||||

|

(1)

|

Consists

of 8,000 under the 2001 Incentive and Nonstatutory Stock Option Plan;

872,000 under the 2002 Incentive and Nonstatutory Stock Option Plan;

475,000 under the 2003 Incentive and Nonstatutory Stock Option Plan;

3,030,275 under the 2004 Incentive and Nonstatutory Stock Option Plan; and

3,321,642 under the 2005 Incentive and Nonstatutory Stock Option

Plan.

|

|

(2)

|

The

weighted average of the options is

$2.16.

|

|

(3)

|

Represents

344,659 available for issuance under the 2003 Incentive and Nonstatutory

Stock Option Plan; 51,754 available for issuance under the 2004 Incentive

and Nonstatutory Stock Option Plan; 1,075,000 available for issuance under

the 2005 Incentive and Nonstatutory Stock Option Plan and 398,000

available for issuance under the 2008 Incentive and Nonstatutory Stock

Option Plan.

|

|

|

o

|

In

2009-2010, to enhance productivity and cost efficiencies, the concept of

Global Delivery Model has been implemented. Without

moving the source codes of US products or UK products to Lahore, Pakistan,

we have integrated the local developers / engineers / programming

resources with PK technology group teams. This model would eventually

create much stronger band width for customers worldwide but also have the

same interfacing local management available for regional clients. In

essence, the concept of BestShoring® model is effectively being

executed.

|

|

|

o

|

The

global delivery model would further streamline the cost base as well as

optimum utilization of NetSol Center of Excellence, CMMI Level 5

technology campus and translate into better and more competitive pricing

modules for our customers.

|

|

|

o

|

Revamped

sales organization from several departments into one group. The newly

created global sales organization under one president of global sales,

centrally headquartered in the UK, would provide much improved visibility

and traction in all key markets worldwide. In addition to achieving

critical mass and visibility the regional sales heads have been created to

directly report to President Group

Sales.

|

|

|

o

|

Key

senior and middle management personnel were relocated in China, USA and UK

to best leverage the talent across the globe and cost

rationalization.

|

|

|

o

|

Substantially

reduced office costs by relocating NTNA staff from Emeryville, California

to Alameda, California by entering a new office lease that will save

nearly $1.0 million in annual rent and maintenance

expenses.

|

|

|

o

|

Engaged

RedChip Companies, Inc. to lead its investor relations programs. RedChip’s

highly professional team, who specialize in the capital market space, was

engaged to strengthen our public relations and assist in building strong

relationships with current and prospective

investors.

|

|

|

o

|

Some

marketing and new project activities had to be slowed down due to the poor

economy but the most strategic new product development and research and

development activities has increased. Management’s vision is that a one

product global solution is the key initiative that will place NetSol in

the next level of critical mass solutions

providers.

|

|

|

·

|

NetSol

launched a long term strategy in 2008 to get NetSol brand and name

recognition in UAE and GCC States by a dual listing on DIFX (now the

NASDAQ DUBAI exchange). Management believes that the signing of a joint

venture agreement with a very well established Saudi Arabian business

conglomerate represents a major break-through for the

Company. The joint venture is a relationship between NetSol

Technologies, Inc. and the Atheeb Group of the Kingdom of Saudi Arabia

(“KSA”). NetSol owns 51% and Atheeb owns 49% of the newly created Atheeb

NetSol, Ltd. to be based in Riyadh, Saudi Arabia. Atheeb has been in

operation since 1985 and has major businesses in defense, public works,

telecom, financial, transportation and agriculture. By partnering with

Atheeb through a joint venture, NetSol gains access to not only major

local projects in key sectors but also to regional economies in GCC

states, Central Asia and Africa. The influence and reputation of Atheeb in

the KSA and regional markets is compelling, and NetSol expects to benefit

handsomely in coming years. The joint venture will fully utilize NetSol

PK’s Lahore based center of excellence, CMMI Level 5 technology

campus.

|

|

|

·

|

The

acquisition of Ciena Solutions for SAP services has been effectively

integrated with NetSol’s operation. Our new SAP services and offerings are

being marketed to our existing US based clients and new markets to

establish a key new vertical. The US clients list

includes a major energy utility company in California. Additionally, we

believe a majority of NetSol global clients could benefit from SAP

services and solutions. The Company is beta testing its product, SMART

OCI, a search engine to expand its SAP product portfolio. The practice was

recently awarded SAP PartnerEdge status as an SAP services

partner.

|

|

|

·

|

By

expanding into the Americas, NetSol sees a strong opportunity to establish

its brand recognition and create critical mass in the

Americas. Despite the recession and consolidations in the

U.S., NetSol has embarked on an aggressive strategy to reposition and

rebrand NetSol for the U.S markets. For example, NetSol is strategically

rolling out offerings of the NetSol Financial Suite™ to our global auto

manufacturers, whether captive or non-captive, in the North and South

American markets. NetSol sees a new market in Mexico,

Brazil, Costa Rica and many countries in Latin America as both mature and

emerging markets are ripe for our flagship NFS™ applications. NetSol added

two new global customers to the Americas in Nissan’s North America and

Mexican operations. In addition, NTNA is experiencing new enhancement and

orders from a few existing clients in North America, reflecting confidence

in our US team.

|

|

|

·

|

Management

envisions a major growth in the Chinese market as China continues to have

strong economic indicators amongst the major industrial countries. Auto

sales in China have surpassed that of the US in numbers of unit sold.

China continues to maintain a GDP rate of 8-9% in 2010, while some of the

western markets are struggling with their economy. China’s market offers a

tremendous opportunity to NetSol as being the leader in leasing and

finance soft ware applications space. China is now the globe’s second

largest economic power and its auto and banking sectors are growing at a

dynamic pace, unlike the western markets. We are expanding the Beijing

office and adding local staff. Our current ten multi-national customers in

China have begun to expand their relationship with NetSol. We recently

signed a few new deals with a few multinational auto companies and

Minsheng Bank, one of the largest in China Management anticipates that the

NFS™ products will demonstrate a noted break through with Chinese

companies in coming months.

|

|

|

·

|

The

European economy has shown serious decline and the severe impact of

consolidation and budget cuts have started to intensely affect our

business there. The European markets are expected to remain sluggish and

we will hold off any further investment until next year. However, it

appears that decisions made by some European nations signal economic

recovery in the major European

economies.

|

|

|

·

|

We

expect top line growth through investment in organic marketing

activities.

|

|

|

·

|

Encourage

organic revenue growth in the Chinese market in the automobile, banking,

manufacturing and captive leasing

sectors.

|

|

|

·

|

Expand

the Beijing office with new local Chinese staff and senior business

development and project management

teams.

|

|

|

·

|

Further

penetrate the Asia Pacific markets by selling NetSol offerings in the key

and robust markets of Australia, New Zealand, Singapore, Thailand, South

Korea and, Japan.

|

|

|

·

|

Expand

Thailand operations with the aim of making it a second hub, after China. A

few senior business development teams have been mobilized and relocated in

Thailand to support the new business development efforts in the APAC

region.

|

|

|

·

|

While

consolidating the development and sales teams, further build and expand in

the North America market. As the most mature and largest market

for the Company’s solutions, North America will remain key to new revenue

in the coming years. NetSol’s existing product line including

LeasePak and its modules will remain as a primary offering to support our

existing customers.

|

|

|

·

|

NetSol

SAP practice will enhance the revenue and add new customers for SAP

consulting service, staffing & proprietary bolt-on software

offerings.

|

|

|

·

|

Expand

and support the new and innovative road map of more capable and robust

solutions to the existing 30 plus US

customers.

|

|

|

·

|

Increase

marketing activities by participating in major forums such as ELFA (the

Equipment Leasing & Finance Association) in North America and many

other selected international forums to grow NetSol business and

image.

|

|

|

·

|

Test

market NFS™ new generation products with key global

customers.

|

|

|

·

|

Expand

and win new customers in the Middle Eastern markets through a recently

formed joint venture with Atheeb Group in the KSA. This will include

sectors in leasing, banking, defense and public

areas.

|

|

|

·

|

Optimize

Lahore’s center of excellence in emerging and growing markets in Middle

East.

|

|

|

·

|

Grow

new revenues in public and defense sectors in

Pakistan.

|

|

|

·

|

Officers

may exercise options that are currently in the

money;

|

|

|

·

|

Company

may look to raise new capital through debt or common stock offerings with

friends of family investors which will be held for long term investment

and require no payment of placement

fees.

|

|

|

·

|

Exercise

of warrants by major fund

investors.

|

|

|

·

|

Newly

hired IR and PR firm will play a major part in expanding the new retail

and institutional investors

base

|

|

|

·

|

Telling

the NetSol story to sell side analysts, funds, portfolio managers and

financial media

|

|

|

·

|

Aggressively

position NetSol in front of major investors’ conferences and road shows to

be organized by RedChip and other major

institutions.

|

|

|

·

|

Push

strategy with US mainstream media to build NetSol image and a ‘Niche’

business offering.

|

|

|

·

|

Founding

management’s aim to continue to invest in the company is anticipated to

display such management’s belief in NetSol’s potential to new

investors.

|

|

|

·

|

Aggressively

enhance the visibility and liquidity in NASDAQDUBAI exchange through road

shows and Middle East focused investors’

conferences.

|

|

|

·

|

Improve

pricing and fee structures.

|

|

|

·

|

Continue

consolidation and reevaluating operating margins as ongoing

activities.

|

|

|

·

|

Streamline

further cost of goods sold to improve gross margins to historical levels

over 60%, as sales ramp up.

|

|

|

·

|

Generate

higher revenues per employee, enhance productivity and lower cost per

employee.

|

|

|

·

|

Optimize

the utilization of NetSol PK resources, infrastructure, processes and

disciplines to maximize the bottom-line and fully leverage the cost

arbitrage.

|

|

|

·

|

Grow

process automation and leverage the best practices of CMMI level 5. Global

delivery concept and integration will further improve both gross and net

margins.

|

|

|

·

|

Cost

efficient management of every operation and continue further consolidation

to improve bottom line.

|

|

|

·

|

Reduced

General and Administrative expense and expenses of marketing

programs.

|

|

|

·

|

Retire

Debt to reduce the interest cost significantly and to make every effort to

avoid any one time charges.

|

|

|

·

|

The

global recession and consolidations have opened doors for low cost

solution providers such as NetSol. The BestShoring® model of NetSol is a

catalyst in today’s environment.

|

|

|

·

|

The

global economic pressures and recession has shifted IT processes and

technology to utilize both offshore and onshore solutions providers, to

control the costs and improve ROIs.

|

|

|

·

|

China

has become the second largest economy and has grown to over 9% GDP a year

while other industrial nations have declined or grown

marginally.

|

|

|

·

|

China’s

automobile and banking sectors have been unaffected by the global meltdown

and in fact have outgrown all other economies with their recent automobile

sales statistics.

|

|

|

·

|

China

sold 58 cars per 1,000 people as compared to 900 cars per 1,000 in the

USA. There is a tremendous opportunity for NetSol’s penetration in China’s

burgeoning leasing and finance market for

NetSol.

|

|

|

·

|

The

surviving IT companies, such as NetSol, with price advantage and a global

presence, will gain further momentum as economic indicators turn positive.

The bigger customers and targeted verticals are much more cost conscious

and are seeking a better rate of return on investments in IT services.

NetSol has an edge due to its BestShoring® model and proven track record

of delivery and implementations

worldwide.

|

|

|

·

|

NetSol

has never lost a product customer despite the recent severe recession. The

dependency of our blue chip clients on NetSol solutions has further

elevated new enhancements and services orders in the

US.

|

|

|

·

|

Improved

outlook and earnings of bell weather technology companies in USA,

reflecting the turnaround of this sector after

recession.

|

|

|

·

|

The

aid and support of trade in Pakistan from countries like the US, China,

Saudi Arabia and other western and friendly countries seems to be growing

recently. This will positively affect NetSol, local employees and

customers worldwide. Pakistan has every potential to rise up as the plans

for energy, power, agriculture and infrastructures (including 12 new dams

to be built by Chinese companies) create a much better outlook and growth

for Pakistan.

|

|

|

·

|

US

AID and many other western agencies are diligently assisting the Pakistani

people to improve literacy, education, poverty alleviation and healthcare

programs. These initiatives will necessarily result in more graduates in

science and technology areas.

|

|

|

·

|

Global

opportunities to diversify delivery capabilities in new emerging economies

that offer geopolitical stability and low cost IT resources reducing

dependency upon Lahore technology

campus.

|

|

|

·

|

Our

global multi-national clients have continued to pursue deeper

relationships in newer regions and countries. This reflects our customers’

dependencies and satisfaction with our NetSol Financial Suite of

products.

|

|

|

·

|

The

levy of Indian IT sector excise tax of 35% (NASSCOM) on software exports

is very positive for NetSol. In Pakistan there is a 15 year tax holiday on

IT exports of services. There are 7 more years remaining on this tax

incentive.

|

|

|

·

|

Geo

political unrest due to extremism in the regions of Pakistan and

Afghanistan.

|

|

|

·

|

The

worst flooding disaster in Pakistan due to heavy monsoon rainfall has

affected more than 20 million people. The rebuilding of the affected areas

will distract the government of Pakistan and

major resources will be diverted to deal with the

aftermath of this disaster. Accordingly, management expects

delays in major public and defense

projects.

|

|

|

·

|

The

emergence of many smaller players offering IT solutions in China has

resulted in competition on pricing.

|

|

|

·

|

The

sluggish European market, due to debt crisis, could lead to our European

business suffering.

|

|

|

·

|

Dramatic

and deep global recession has created a serious decline in business

spending causing significant budget cuts for many of the Company’s target

verticals.

|

|

|

·

|

Tightened

liquidity and credit restrictions in consumer spending has either delayed

or reduced spending on business solutions and systems squeezing IT budgets

and elongating decision making

cycles.

|

|

|

·

|

Tighter

internal processes and budgets will cause delays in the receivables from

few clients.

|

|

|

·

|

Challenged

US auto sectors, banking and retail sectors, thus resulting in longer

sales and closing cycles.

|

|

|

·

|

Anticipated

worsening US deficit and rise in inflation in coming years would further

put stress on consumers and business

spending.

|

|

|

·

|

Unrest

and growing war in Afghanistan could increase the migration of both

refugees and extremists to Pakistan, thus creating domestic and regional

challenges.

|

|

Reporting Units

|

2010

|

2009

|

||||||

|

Asia

Pacific

|

$ | 1,303,372 | $ | 1,303,372 | ||||

|

Europe

|

3,471,813 | 3,471,813 | ||||||

|

North

America

|

4,664,100 | 4,664,100 | ||||||

|

Total

|

$ | 9,439,285 | $ | 9,439,285 | ||||

|

Reporting Units

|

Percentage by which fair

value exceeds carrying value

|

|||

|

Asia

Pacific

|

92.78 | % | ||

|

Europe

|

62.28 | % | ||

|

North

America

|

15.3 | % | ||

|

2010

|

2009

|

|||||||||||||||

|

Revenue

|

%

|

Revenue

|

%

|

|||||||||||||

|

North

America:

|

||||||||||||||||

|

NTNA

|

$ | 5,627,277 | 15.30 | % | $ | 5,396,693 | 20.40 | % | ||||||||

| 5,627,277 | 15.30 | % | 5,396,693 | 20.40 | % | |||||||||||

|

Europe:

|

||||||||||||||||

|

Netsol

UK

|

- | 0.00 | % | - | 0.00 | % | ||||||||||

|

NTE

|

5,105,434 | 13.88 | % | 3,886,337 | 14.69 | % | ||||||||||

| 5,105,434 | 13.88 | % | 3,886,337 | 14.69 | % | |||||||||||

|

Asia-Pacific:

|

||||||||||||||||

|

Netsol

Tech (PK)

|

21,397,724 | 58.18 | % | 13,265,196 | 50.16 | % | ||||||||||

|

EI

|

2,210,357 | 6.01 | % | 3,098,353 | 11.71 | % | ||||||||||

|

Netsol

Connect

|

542,521 | 1.48 | % | 673,256 | 2.55 | % | ||||||||||

|

Netsol-Abraxas

Australia

|

96,583 | 0.26 | % | 128,342 | 0.49 | % | ||||||||||

|

Netsol-Thailand

|

1,800,000 | 4.89 | % | 0.00 | % | |||||||||||

| 26,047,185 | 70.82 | % | 17,165,147 | 64.90 | % | |||||||||||

|

Total

|

$ | 36,779,897 | 100.00 | % | $ | 26,448,177 | 100.00 | % | ||||||||

|

For the Year

|

||||||||||||||||

|

Ended June 30,

|

||||||||||||||||

|

2010

|

2009

|

|||||||||||||||

|

%

|

%

|

|||||||||||||||

|

Net

Revenues:

|

||||||||||||||||

|

License

fees

|

$ | 14,157,107 | 38.49 | % | $ | 4,786,332 | 18.10 | % | ||||||||

|

Maintenance

fees

|

7,047,936 | 19.16 | % | 6,499,419 | 24.57 | % | ||||||||||

|

Services

|

15,574,853 | 42.35 | % | 15,162,426 | 57.33 | % | ||||||||||

|

Total

revenues

|

36,779,897 | 100.00 | % | 26,448,177 | 100.00 | % | ||||||||||

|

Cost

of revenues:

|

||||||||||||||||

|

Salaries

and consultants

|

8,164,148 | 22.20 | % | 9,787,965 | 37.01 | % | ||||||||||

|

Travel

|

843,626 | 2.29 | % | 1,334,879 | 5.05 | % | ||||||||||

|

Repairs

and maintenance

|

256,997 | 0.70 | % | 370,487 | 1.40 | % | ||||||||||

|

Insurance

|

140,496 | 0.38 | % | 174,761 | 0.66 | % | ||||||||||

|

Depreciation

and amortization

|

2,298,092 | 6.25 | % | 2,214,211 | 8.37 | % | ||||||||||

|

Other

|

2,163,689 | 5.88 | % | 3,316,031 | 12.54 | % | ||||||||||

|

Total

cost of revenues

|

13,867,048 | 37.70 | % | 17,198,334 | 65.03 | % | ||||||||||

|

Gross

profit

|

22,912,849 | 62.30 | % | 9,249,843 | 34.97 | % | ||||||||||

|

Operating

expenses:

|

||||||||||||||||

|

Selling

and marketing

|

2,222,841 | 6.04 | % | 3,115,883 | 11.78 | % | ||||||||||

|

Depreciation

and amortization

|

1,609,854 | 4.38 | % | 1,973,997 | 7.46 | % | ||||||||||

|

Bad

debt expense

|

442,804 | 1.20 | % | 2,393,685 | 9.05 | % | ||||||||||

|

Salaries

and wages

|

3,026,275 | 8.23 | % | 3,443,390 | 13.02 | % | ||||||||||

|

Professional

services, including non-cash compensation

|

900,125 | 2.45 | % | 1,215,939 | 4.60 | % | ||||||||||

|

Lease

abandonment charges

|

867,583 | 2.36 | % | - | 0.00 | % | ||||||||||

|

General

and adminstrative

|

4,115,658 | 11.19 | % | 3,590,118 | 13.57 | % | ||||||||||

|

Total

operating expenses

|

13,185,141 | 35.85 | % | 15,733,012 | 59.49 | % | ||||||||||

|

Income

(loss) from operations

|

9,727,708 | 26.45 | % | (6,483,169 | ) | -24.51 | % | |||||||||

|

Other

income and (expenses)

|

||||||||||||||||

|

Loss

on sale of assets

|

(224,741 | ) | -0.61 | % | (404,820 | ) | -1.53 | % | ||||||||

|

Interest

expense

|

(1,478,474 | ) | -4.02 | % | (1,294,293 | ) | -4.89 | % | ||||||||

|

Interest

income

|

261,296 | 0.71 | % | 291,030 | 1.10 | % | ||||||||||

|

(Loss)

gain on foreign currency exchange transactions

|

(66,919 | ) | -0.18 | % | 2,371,487 | 8.97 | % | |||||||||

|

Gain

on sale of subsidiary shares

|

- | 0.00 | % | 351,522 | 1.33 | % | ||||||||||

|

Share

of net loss from equity investment

|

(67,494 | ) | -0.18 | % | - | 0.00 | % | |||||||||

|

Beneficial

conversion feature

|

(1,867,787 | ) | -5.08 | % | (40,277 | ) | -0.15 | % | ||||||||

|

Other

income (expense)

|

56,571 | 0.15 | % | (931,253 | ) | -3.52 | % | |||||||||

|

Total

other income (expenses)

|

(3,387,548 | ) | -9.21 | % | 343,396 | 1.30 | % | |||||||||

|

Net

income (loss) before non-controlling interest in subsidiary and income

taxes

|

6,340,160 | 17.24 | % | (6,139,773 | ) | -23.21 | % | |||||||||

|

Income

taxes

|

(53,943 | ) | -0.15 | % | (91,132 | ) | -0.34 | % | ||||||||

|

Non-controlling

interest

|

(4,892,097 | ) | -13.30 | % | (1,816,143 | ) | -6.87 | % | ||||||||

|

Net

income (loss) attributable to NetSol

|

1,394,120 | 3.79 | % | (8,047,048 | ) | -30.43 | % | |||||||||

|

2010

|

2009

|

|||||||||||||||

|

Revenue

|

%

|

Revenue

|

%

|

|||||||||||||

|

North

America:

|

||||||||||||||||

|

Netsol

Tech NA

|

$ | 1,270,200 | 11.87 | % | $ | 1,351,643 | 19.72 | % | ||||||||

| 1,270,200 | 11.87 | % | 1,351,643 | 19.72 | % | |||||||||||

|

Europe:

|

||||||||||||||||

|

Netsol

UK

|

- | 0.00 | % | - | 0.00 | % | ||||||||||

|

Netsol

Tech Europe

|

799,402 | 7.47 | % | 546,704 | 7.98 | % | ||||||||||

| 799,402 | 7.47 | % | 546,704 | 7.98 | % | |||||||||||

|

Asia-Pacific:

|

||||||||||||||||

|

Netsol

Tech (PK)

|

7,172,319 | 67.00 | % | 4,126,774 | 60.22 | % | ||||||||||

|

Netsol-Innovation

|

511,288 | 4.78 | % | 631,236 | 9.21 | % | ||||||||||

|

Netsol

Connect

|

126,106 | 1.18 | % | 131,175 | 1.91 | % | ||||||||||

|

Netsol-Abraxas

Australia

|

20,745 | 0.19 | % | 65,648 | 0.96 | % | ||||||||||

|

Netsol-Thailand

|

805,000 | 7.52 | % | - | 0.00 | % | ||||||||||

| 8,635,458 | 80.67 | % | 4,954,833 | 72.30 | % | |||||||||||

|

Total

|

$ | 10,705,060 | 100.00 | % | $ | 6,853,180 | 100.00 | % | ||||||||

|

For the Three Months

|

||||||||||||||||

|

Ended June 30,

|

||||||||||||||||

|

2010

|

2009

|

|||||||||||||||

|

%

|

%

|

|||||||||||||||

|

Net

Revenues:

|

||||||||||||||||

|

License

fees

|

$ | 4,641,770 | 43.36 | % | $ | 1,283,700 | 18.73 | % | ||||||||

|

Maintenance

fees

|

1,720,084 | 16.07 | % | 1,727,900 | 25.21 | % | ||||||||||

|

Services

|

4,343,206 | 40.57 | % | 3,841,580 | 56.06 | % | ||||||||||

|

Total

revenues

|

10,705,060 | 100.00 | % | 6,853,180 | 100.00 | % | ||||||||||

|

Cost

of revenues:

|

||||||||||||||||

|

Salaries

and consultants

|

1,990,180 | 18.59 | % | 2,135,294 | 31.16 | % | ||||||||||

|

Travel

|

232,283 | 2.17 | % | 341,589 | 4.98 | % | ||||||||||

|

Repairs

and maintenance

|

76,911 | 0.72 | % | 80,051 | 1.17 | % | ||||||||||

|

Insurance

|

27,553 | 0.26 | % | 39,371 | 0.57 | % | ||||||||||

|

Depreciation

and amortization

|

647,415 | 6.05 | % | 598,358 | 8.73 | % | ||||||||||

|

Other

|

279,263 | 2.61 | % | 1,107,766 | 16.16 | % | ||||||||||

|

Total

cost of revenues

|

3,253,605 | 30.39 | % | 4,302,429 | 62.78 | % | ||||||||||

|

Gross

profit

|

7,451,454 | 69.61 | % | 2,550,751 | 37.22 | % | ||||||||||

|

Operating

expenses:

|

||||||||||||||||

|

Selling

and marketing

|

550,307 | 5.14 | % | 636,374 | 9.29 | % | ||||||||||

|

Depreciation

and amortization

|

267,907 | 2.50 | % | 497,716 | 7.26 | % | ||||||||||

|

Bad

debt expense

|

233,200 | 2.18 | % | (26,973 | ) | -0.39 | % | |||||||||

|

Salaries

and wages

|

811,515 | 7.58 | % | 745,859 | 10.88 | % | ||||||||||

|

Professional

services, including non-cash compensation

|

350,647 | 3.28 | % | 338,187 | 4.93 | % | ||||||||||

|

General

and adminstrative

|

849,398 | 7.93 | % | 896,667 | 13.08 | % | ||||||||||

|

Total

operating expenses

|

3,062,974 | 28.61 | % | 3,087,830 | 45.06 | % | ||||||||||

|

Income

(loss) from operations

|

4,388,481 | (537,079 | ) | -7.84 | % | |||||||||||

|

Other

income and (expenses)

|

||||||||||||||||

|

Loss

on sale of assets

|

(10,221 | ) | -0.10 | % | (96,564 | ) | -1.41 | % | ||||||||

|

Interest

expense

|

(314,981 | ) | -2.94 | % | (327,547 | ) | -4.78 | % | ||||||||

|

Interest

income

|

27,096 | 0.25 | % | 44,423 | 0.65 | % | ||||||||||

|

(Loss)

gain on foreign currency exchange transactions

|

(257,414 | ) | -2.40 | % | 549,733 | 8.02 | % | |||||||||

|

Gain

on sale of subsidiary shares

|

- | 0.00 | % | 351,522 | 5.13 | % | ||||||||||

|

Share

of net loss from equity investment

|

(43,510 | ) | -0.41 | % | - | 0.00 | % | |||||||||

|

Beneficial

conversion feature

|

(515,815 | ) | -4.82 | % | (23,052 | ) | -0.34 | % | ||||||||

|

Other

income (expense)

|

(94,426 | ) | -0.88 | % | 21,229 | 0.31 | % | |||||||||

|

Total

other income (expenses)

|

(1,209,271 | ) | -11.30 | % | 519,744 | 7.58 | % | |||||||||

|

Net

income (loss) before non-controlling interest in subsidiary and income

taxes

|

3,179,209 | 29.70 | % | (17,335 | ) | -0.25 | % | |||||||||

|

Income

taxes

|

(5,337 | ) | -0.05 | % | (11,501 | ) | -0.17 | % | ||||||||

|

Non-controlling

interest

|

(1,657,004 | ) | -15.48 | % | (843,904 | ) | -12.31 | % | ||||||||

|

Net

income (loss) attributable to NetSol

|

1,516,869 | 14.17 | % | (872,740 | ) | -12.73 | % | |||||||||

|

Name

|

Year First Elected

As an Officer or

Director

|

Age

|

Position Held with the

Registrant

|

Family Relationship

|

||||

|

Najeeb

Ghauri

|

1997

|

55

|

Director

and Chairman

|

Brother

to Naeem and Salim Ghauri

|

||||

|

Salim

Ghauri

|

1999

|

54

|

President

and Director

|

Brother

to Naeem and Najeeb Ghauri

|

||||

|

Naeem

Ghauri

|

1999

|

52

|

Chief

Executive Officer, Director

|

Brother

to Najeeb and Salim Ghauri

|

||||

|

Boo-Ali

Siddiqui

|

2009

|

36

|

Chief

Financial Officer

|

None

|

||||

|

Patti

L. W. McGlasson

|

2004

|

45

|

Secretary,

General Counsel

|

None

|

||||

|

Shahid

Javed Burki

|

2000

|

71

|

Director

|

None

|

||||

|

Eugen

Beckert

|

2001

|

63

|

Director

|

None

|

||||

|

Mark

Caton

|

2002

|

60

|

Director

|

None

|

||||

|

Alexander

Shakow

|

2007

|

73

|

Director

|

None

|

|

Najeeb

Ghauri

|

Chief

Executive Officer

|

|

Salim

Ghauri

|

President

of Asia Pacific and Middle East Operations

|

|

Naeem

Ghauri

|

President

of European Operations

|

|

Boo

Ali

|

Chief

Financial Officer

|

|

Patti

L. W. McGlasson

|

Secretary

and General Counsel

|

|

Name and Principle Position

|

Fiscal

Year

Ended

|

Salary ($)

|

Bonus ($)

|

Stock

Awards

($) (1)

|

Option

Awards ($)

|

All Other

Compensation

($)

|

Total ($)

|

|||||||||||||||||||

|

Najeeb

Ghauri

|

2010

|

$ | 315,000 | $ | - | $ | 99,375 | $ | 94,772 | $ | 70,981 |

(2)

|

$ | 580,128 | ||||||||||||

|

CEO

& Chairman

|

2009

|

$ | 272,265 | $ | - | $ | - | $ | 58,290 | $ | 36,000 | $ | 366,555 | |||||||||||||

|

Naeem

Ghauri

|

2010

|

$ | 225,000 | $ | - | $ | 99,375 | $ | 66,340 | $ | 27,000 |

(3)

|

$ | 417,715 | ||||||||||||

|

President

EMEA Region

|

2009

|

$ | 200,000 | $ | - | $ | - | $ | 40,802 | $ | 25,686 | $ | 266,488 | |||||||||||||

|

Salim

Ghauri

|

2010

|

$ | 212,500 | $ | - | $ | 99,375 | $ | 66,340 | $ | 9,918 |

(4)

|

$ | 388,133 | ||||||||||||

|

President

APAC Region

|

2009

|

$ | 175,000 | $ | - | $ | - | $ | 40,802 | $ | - | $ | 215,802 | |||||||||||||

|

Boo-Ali

Siddiqui

|

2010

|

$ | 75,000 | $ | - | $ | 9,000 | $ | - | $ | - |

(4)

|

$ | 84,000 | ||||||||||||

|

Chief

Financial Officer

|

2009

|

$ | 15,000 | $ | - | $ | 6,400 | $ | - | $ | - | $ | 21,400 | |||||||||||||

|

Dan

Lee

|

2010

|

$ | - | $ | - | $ | - | $ | - | $ | - |

(4)

|

$ | - | ||||||||||||

|

Chief

Financial Officer

|

2009

|

$ | 58,333 | $ | - | $ | 13,340 | $ | - | $ | 4,245 | $ | 75,918 | |||||||||||||

|

Tina

Gilger

|

2010

|

$ | - | $ | - | $ | - | $ | - | $ | - |

(4)

|

$ | - | ||||||||||||

|

Chief

Financial Officer

|

2009

|

$ | 70,360 | $ | 5,000 | $ | - | $ | - | $ | - | $ | 75,360 | |||||||||||||

|

Patti

L. W. McGlasson

|

2010

|

$ | 122,747 | $ | - | $ | 7,200 | $ | - | $ | 23,594 |

(5)

|

$ | 153,541 | ||||||||||||

|

Secretary,

General Counsel

|

2009

|

$ | 124,289 | $ | 5,000 | $ | 17,200 | $ | - | $ | - | $ | 146,489 | |||||||||||||

|

NAME

|

NUMBER OF

SECURITIES

UNDERLYING

OPTIONS (#)

EXERCISABLE

|

NUMBER OF

SECURITIES

UNDERLYING

OPTIONS (#)

UNEXERCISABLE

|

OPTION

EXERCISE

PRICE ($)

|

OPTION

EXPIRATION

DATE

|

|||||||||

|

Najeeb

Ghauri

|

100,000 | - | 2.21 |

1/1/14

|

|||||||||

| 100,000 | 3.75 |

1/1/14

|

|||||||||||

| 50,000 | 5.00 |

1/1/14

|

|||||||||||

| 20,000 | 2.64 |

3/26/14

|

|||||||||||

| 30,000 | 5.00 |

3/26/14

|

|||||||||||

| 374,227 | 1.94 |

4/1/15

|

|||||||||||

| 500,000 | 2.91 |

4/1/15

|

|||||||||||

| 167,214 | 1.83 |

6/2/16

|

|||||||||||

| 250,000 | 2.50 |

6/2/16

|

|||||||||||

| 750,000 | 0.65 |

2/12/19

|

|||||||||||

|

Naeem

Ghauri

|

100,000 | - | 2.21 |

1/2/14

|

|||||||||

| 100,000 | 3.75 |

1/2/14

|

|||||||||||

| 50,000 | 5.00 |

1/2/14

|

|||||||||||

| 20,000 | 2.64 |

3/26/14

|

|||||||||||

| 30,000 | 5.00 |

3/26/14

|

|||||||||||

| 10,000 | 2.50 |

2/16/12

|

|||||||||||

| 374,227 | 1.94 |

4/1/15

|

|||||||||||

| 500,000 | 2.91 |

4/1/15

|

|||||||||||

| 217,214 | 1.83 |

6/2/16

|

|||||||||||

| 250,000 | 2.50 |

6/2/16

|

|||||||||||

| 525,000 | 0.65 |

2/12/19

|

|||||||||||

|

Salim

Ghauri

|

100,000 | - | 2.21 |

1/2/14

|

|||||||||

| 100,000 | 3.75 |

1/2/14

|

|||||||||||

| 50,000 | 5.00 |

3/26/14

|

|||||||||||

| 20,000 | 2.64 |

3/26/14

|

|||||||||||

| 30,000 | 5.00 |

3/26/14

|

|||||||||||

| 20,000 | 2.50 |

2/16/12

|

|||||||||||

| 374,227 | 1.94 |

4/1/15

|

|||||||||||

| 500,000 | 2.91 |

4/1/15

|

|||||||||||

| 217,214 | 1.83 |

6/2/16

|

|||||||||||

| 250,000 | 2.50 |

6/2/16

|

|||||||||||

| 525,000 | 0.65 |

2/12/19

|

|||||||||||

|

Boo-Ali

Siddiqui

|

- | - | - |

1/0/00

|

|||||||||

|

Patti

L. W. McGlasson

|

10,000 | - | 3.00 |

1/1/14

|

|||||||||

| 20,000 | 2.64 |

3/26/14

|

|||||||||||

| 30,000 | 5.00 |

3/26/14

|

|||||||||||

| 20,000 | 1.65 |

7/7/15

|

|||||||||||

| 20,000 | 2.25 |

7/7/15

|

|||||||||||

| 10,000 | 1.60 |

7/23/17

|

|||||||||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||||

|

Base

Salary

|

$ | 1,125,000 | $ | - | $ | 1,125,000 | ||||||

|

Bonus

|

- | |||||||||||

|

Salary

Multiple Pay-out

|

897,000 | |||||||||||

|

Bonus

or Revenue One-time Pay-Out

|

367,799 | |||||||||||

|

Net

Cash Value of Options

|

4,648,302 | |||||||||||

|

Total

|

$ | 7,038,101 | $ | - | $ | 1,125,000 | ||||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||||

|

Base

Salary

|

$ | 750,000 | $ | - | $ | 750,000 | ||||||

|

Bonus

|

- | |||||||||||

|

Salary

Multiple Pay-out

|

598,000 | |||||||||||

|

Bonus

or Revenue One-time Pay-Out

|

367,799 | |||||||||||

|

Net

Cash Value of Options

|

4,618,552 | |||||||||||

|

Total

|

$ | 6,334,351 | $ | - | $ | 750,000 | ||||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||||

|

Base

Salary

|

$ | 750,000 | $ | - | $ | 750,000 | ||||||

|

Bonus

|

- | |||||||||||

|

Salary

Multiple Pay-out

|

598,000 | |||||||||||

|

Bonus

or Revenue One-time Pay-Out

|

367,799 | |||||||||||

|

Net

Cash Value of Options

|

4,643,552 | |||||||||||

|

Total

|

$ | 6,359,351 | $ | - | $ | 750,000 | ||||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||||

|

Base

Salary

|

$ | 14,000 | $ | - | $ | 14,000 | ||||||

|

Bonus

|

- | |||||||||||

|

Salary

Multiple Pay-out

|

125,580 | |||||||||||

|

Bonus

or Revenue One-time Pay-Out

|

98,190 | |||||||||||

|

Net

Cash Value of Options

|

- | |||||||||||

|

Total

|

$ | 237,770 | $ | - | $ | 14,000 | ||||||

|

BENEFITS AND PAYMENTS

|

CHANGE

OF

CONTROL

|

TERMINATION

UPON DEATH

OR

DISABILITY

|

TERMINATION

BY US

WITHOUT

CAUSE OR BY

EXECUTIVE

FOR GOOD

REASON

|

|||||||||

|

Base

Salary

|

$ | 130,000 | $ | - | $ | 130,000 | ||||||

|

Bonus

|

- | |||||||||||

|

Salary

Multiple Pay-out

|

371,624 | |||||||||||

|

Bonus

or Revenue One-time Pay-Out

|

183,899 | |||||||||||

|

Net

Cash Value of Options

|

326,800 | |||||||||||

|

Total

|

$ | 1,012,324 | $ | - | $ | 130,000 | ||||||

|

NAME

|

FEES

EARNED

OR PAID

IN CASH

($)

|

SHARES

AWARDS

($) (1)

|

TOTAL

($)

|

|||||||||

|

Eugen

Beckert

|

21,288 | 15,275 | 36,563 | |||||||||

|

Shahid

Javed Burki

|

26,612 | 15,275 | 41,887 | |||||||||

|

Mark

Caton

|

23,950 | 15,275 | 39,225 | |||||||||

|

Alexander

Shakow

|

15,075 | 15,275 | 30,350 | |||||||||

|

(1)

|

During

the fiscal year ended June 30, 2010, 17,500 shares were issued to each

independent director valuing

$15,275

|

|

BOARD ACTIVITY

|

CASH

PAYMENTS

|

|||

|

Board

Member Fee

|

$ | 39,000 | ||

|

Committee

Membership

|

$ | 15,975 | ||

|

Chairperson

for Audit Committee

|

$ | 13,312 | ||

|

Chairperson

for Compensation Committee

|

$ | 10,650 | ||

|

Chairperson

for Nominating and Corporate Governance Committee

|

$ | 7,988 | ||

|

Percentage

|

||||||||

|

Najeeb

Ghauri (3)

|

4,077,823 | 10.14 | % | |||||

|

Naeem

Ghauri (3)

|

3,253,682 | 8.09 | % | |||||

|

Salim

Ghauri (3)

|

3,294,116 | 8.19 | % | |||||

|

Eugen

Beckert (3)

|

278,900 | * | ||||||

|

Shahid

Javed Burki (3)

|

265,000 | * | ||||||

|

Mark

Caton (3)

|

57,700 | * | ||||||

|

Alexander

Shakow (3)

|

50,273 | * | ||||||

|

Patti

McGlasson (3)

|

165,500 | * | ||||||

|

Boo-Ali

Siddiqui (3)

|

32,500 | * | ||||||

|

The

Tail Wind Fund Ltd.(5)(6)

|

3,822,192 | 9.51 | % | |||||

|

Newland

Capital Management LLC(7)

|

3,405,414 | 8.47 | % | |||||

|

All

officers and directors

|

||||||||

|

as

a group (nine persons)

|

11,475,494 | 28.54 | % | |||||

|

|

(i)

|

Approves the performance by the

independent auditors of certain types of service (principally

audit-related and tax), subject to restrictions in some cases, based on

the Committee’s determination that this would not be likely to impair the

independent auditors’ independence from

NetSol;

|

|

(ii)

|

Requires that management obtain

the specific prior approval of the Audit Committee for each engagement of

the independent auditors to perform other types of permitted services;

and,

|

|

(iii)

|

Prohibits the performance by the

independent auditors of certain types of services due to the likelihood

that their independence would be

impaired.

|

| (a) Exhibits | |||

|

3.1

|

Articles

of Incorporation of Mirage Holdings, Inc., a Nevada corporation, dated

March 18, 1997,

|

||

|

incorporated

by reference as Exhibit 3.1 to NetSol’s Registration Statement No.

333-28861 filed on

|

|||

|

Form

SB-2 filed June 10, 1997.*

|

|||

|

3.2

|

Amendment

to Articles of Incorporation dated May 21, 1999, incorporated by reference

as Exhibit 3.2 to NetSol’s Annual Report for the fiscal year ended June

30, 1999 on Form 10K-SB filed September 28, 1999.*

|

||

|

3.3

|

Amendment

to the Articles of Incorporation of NetSol International, Inc. dated March

20, 2002 incorporated by reference as Exhibit 3.3 to NetSol’s Annual

Report on Form 10-KSB/A filed on February 2, 2001.*

|

||

|

3.4

|

Amendment

to the Articles of Incorporation of NetSol Technologies, Inc. dated August

20, 2003 filed as Exhibit A to NetSol’s Definitive Proxy Statement filed

June 27, 2003.*

|

||

|

3.5

|

Amendment

to the Articles of Incorporation of NetSol Technologies, Inc. dated March

14, 2005 filed as Exhibit 3.0 to NetSol’s quarterly report filed on Form

10-QSB for the period ended March 31, 2005.*

|

||

|

3.6

|

Amendment

to the Articles of Incorporation dated October 18, 2006 filed as Exhibit

3.5 to NetSol’s Annual Report for the fiscal year ended June 30, 2007 on

Form 10-KSB.*

|

||

|

3.7

|

Amendment

to Articles of Incorporation dated May 12, 2008 (1)*

|

||

|

3.8

|

Bylaws

of Mirage Holdings, Inc., as amended and restated as of November 28, 2000

incorporated by reference as Exhibit 3.3 to NetSol’s Annual Report for the

fiscal year ending in June 30, 2000 on Form 10K-SB/A filed on February 2,

2001.*

|

||

|

3.9

|

Amendment

to the Bylaws of NetSol Technologies, Inc. dated February 16, 2002

incorporated by reference as Exhibit 3.5 to NetSol’s Registration

Statement filed on Form S-8 filed on March 27, 2002.*

|

||

|

4.1

|

Form

of Common Stock Certificate*

|

||

|

4.2

|

Form

of Warrant*.

|

||

|

4.3

|

Form

of Series A 7% Cumulative Preferred Stock filed as Annex E to NetSol’s

Definitive Proxy Statement filed September 18, 2006*.

|

||

|

10.1

|

Lease

Agreement for Calabasas executive offices dated December 3, 2003

incorporated by reference as Exhibit 99.1 to NetSol’s Current Report filed

on Form 8-K filed on December 24, 2003.*

|

||

|

10.2

|

Company

Stock Option Plan dated May 18, 1999 incorporated by reference as Exhibit

10.2 to the Company’s Annual Report for the Fiscal Year Ended June 30,

1999 on Form 10K-SB filed September 28, 1999.*

|

||

|

10.3

Company Stock Option Plan dated April 1, 1997 incorporated by reference as

Exhibit 10.5 to NetSol’s Registration Statement No. 333-28861 on Form SB-2

filed June 10, 1997*

|

|||

|

10.4

Company 2003 Incentive and Nonstatutory incorporated by reference as

Exhibit 99.1 to NetSol’s Definitive Proxy Statement filed February 6,

2004.*

|

|||

|

10.5

|

Company

2001 Stock Options Plan dated March 27, 2002 incorporated by reference as

Exhibit 5.1 to NetSol’s Registration Statement on Form S-8 filed on March

27, 2002.*

|

||

|

10.6

|

Company

2008 Equity Incentive Plan incorporated by reference as Annex A to

NetSol’s Definitive Proxy Statement filed May 28,

2008.*

|

||

|

10.6

Frame Agreement by and between DaimlerChrysler Services AG and NetSol

Technologies dated June 4, 2004 incorporated by reference as Exhibit 10.13

to NetSol’s Annual Report for the year ended June 30, 2005 on Form 10-KSB

filed on September 15, 2005.*

|

|||

|

10.7

|

Share

Purchase Agreement dated as of January 19, 2005 by and between the Company

and the shareholders of CQ Systems Ltd. incorporated by reference as

Exhibit 2.1 to NetSol’s Current Report filed on form 8-K on January 25,

2005.*

|

||

|

10.8

|

Stock

Purchase Agreement dated May 6, 2006 by and between the Company, McCue

Systems, Inc. and the shareholders of McCue Systems, Inc. incorporated by

reference as Exhibit 2.1 to NetSol’s Current Report filed on form 8-K on

May 8, 2006.*

|

||

|

10.9

|

Employment

Agreement by and between NetSol Technologies, Inc. and Patti L. W.

McGlasson dated May 1, 2006 incorporated by reference as Exhibit 10.20 to

NetSol’s Annual Report on form 10-KSB dated September 18,

2006.*

|

||

|

10.11.

|

Employment

Agreement by and between the Company and Najeeb Ghauri dated January 1,

2007 filed as Exhibit 10.11 to the Company’s Annual Report filed on Form

10-KSB for the year ended June 30, 2007.*

|

||

|

10.12

|

Employment

Agreement by and between the Company and Naeem Ghauri dated January 1,

2007 filed as Exhibit 10.11 to the Company’s Annual Report filed on Form

10-KSB for the year ended June 30, 2007.*

|

||

|

10.13

|

Employment

Agreement by and between the Company and Salim Ghauri dated January 1,

2007 filed as Exhibit 10.11 to the Company’s Annual Report filed on Form

10-KSB for the year ended June 30, 2007.*

|

||

|

10.14

|

Employment

Agreement by and between the Company and Tina Gilger dated August 1, 2007

filed as Exhibit 10.11 to the Company’s Annual Report filed on Form 10-KSB

for the year ended June 30, 2007.*

|

||

|

10.15

|

Amendment

to Employment Agreement by and between Company and Najeeb Ghauri dated

effective January 1,

2007.*

|

||

|

|

10.16

|

Amendment

to Employment Agreement by and between Company and Naeem Ghauri dated

effective January 1, 2007. *

|

|

|

10.17

|

Amendment

to Employment Agreement by and between Company and Salim Ghauri dated

effective January 1,*

|

||

|

10.18

|

Lease

Agreement by and between McCue Systems, Inc. and Sea Breeze 1 Venture

dated April 29, 2003*.

|

||

|

10.19

|

Amendment

to Lease Agreement by and between McCue Systems, Inc. and Sea Breeze 1

Venture dated June 25, 2007 filed as Exhibit 10.19 to the Company’s Annual

Report filed on Form 10-KSB for the year ended June 30, 2007.

*

|

||

|

10.20

|

Lease

Agreement by and between NetSol Pvt Limited and Civic Centres Company

(PVT) Limited dated May 28, 2001 incorporated by this reference as Exhibit

10.23 to NetSol’s Annual Report on form 10-KSB dated September 18,

2006.*

|

||

|

10.21

|

Lease

Agreement by and between NetSol Pvt Limited and Mrs. Rameeza Zobairi dated

December 5, 2005 incorporated by this reference as Exhibit 10.24 to

NetSol’s Annual Report on form 10-KSB dated September 18,

2006.*

|

||

|

10.22

|

Lease

Agreement by and between NetSol Pvt Limited and Mr. Nisar Ahmed dated May

4, 2006 incorporated by this reference as Exhibit 10.25 to NetSol’s Annual

Report on form 10-KSB dated September 18, 2006.*

|

||

|

10.23

|

Lease

Agreement by and between NetSol Technologies, Ltd. and Argyll Business

Centres Limited dated April 28, 2006 incorporated by this reference as

Exhibit 10. 26 to NetSol’s Annual Report on form 10-KSB dated September

18, 2006.*

|

||

|

10.24

|

Tenancy

Agreement by and between NetSol Technologies, Ltd. and Beijing Lucky

Goldstar Building Development Co. Ltd. dated June 26, 2007 filed as

Exhibit 10.21 to the Company’s Annual Report filed on Form 10-KSB for the

year ended June 30, 2007.*

|

||

|

10.25

|

Company

2005 Stock Option Plan incorporated by reference as Exhibit 99.1 to

NetSol’s Definitive Proxy Statement filed on March 3,

2006.*

|

||

|

10.26

|

Company

2004 Stock Option Plan incorporated by reference as Exhibit 99.1 to

NetSol’s Definitive Proxy Statement filed on February 7,

2005.*

|

||

|

10.27

|

Working

area sublease by and between NetSol Technologies, Ltd. and Toyota Leasing

(Thailand) Co. Ltd., dated June 21, 2007 filed as Exhibit 10.24 to the

Company’s Annual Report filed on Form 10-KSB for the year ended June 30,

2007.*

|

||

|

10.28

|

Lease

Agreement by and between NetSol Technologies, Inc. and NetSol Technologies

North America, Inc. and NOP Watergate LLC dated April 3,

2008.*

|

||

|

10.29

|

Lease

Amendment Number Three by and between NetSol Technologies, Inc. and

Century National Properties, Inc. dated December 12, 2007.

*

|

||

|

10.30

|

Rent

Agreement by and between Mr. Tahir Mehmood Khan and NetSol Technologies

Ltd. Dated January 21, 2008. *

|

||

|

10.31

|

Amendment

to Employment Agreement by and between Company and Najeeb Ghauri dated

effective January 1, 2010. *

|

||

|

10.32

|

Amendment

to Employment Agreement by and between Company and Naeem Ghauri dated

effective January 1, 2010.*

|

||

|

10.33

|

Amendment

to Employment Agreement by and between Company and Salim Ghauri dated

effective January 1, 2010.*

|

||

|

10.34

|

Lease

Amendment No. 4 by and between NetSol Technologies, Inc. and Century

National Properties, Inc. dated October 7, 2009.(1)

|

||

|

10.35

|

Office

Lease by and between NetSol Technologies North America, Inc. and Legacy

Partners I Alameda Mariner Loop, LLC dated November 27,

2009.(1)

|

||

|

10.36

|

Amendment

to Employment Agreement by and between Company and Patti L. W. McGlasson

dated effective April 1, 2010.*

|

||

|

10.37

|

Employment

Agreement by and between Company and Boo-Ali Siddiqui dated effective

April 1, 2010.*

|

||

|

21.1

|

A

list of all subsidiaries of the Company*

|

||

|

23.1

|

Consent

of Kabani & Company(1)

|

||

|

31.1

|

Certification

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (CEO)

(1)

|

||

|

31.2

|

Certification

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (CFO)

(1)

|

||

|

32.1

|

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of

the Sarbanes- Oxley Act of 2002 (CEO)(1)

|

||

|

32.2

|

Certification

pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of

the Sarbanes-Oxley act of 2002

(CFO)(1)

|

|

NetSol

Technologies, Inc.

|

||

|

Date:

January 31, 2011

|

BY:

|

/S/ NAJEEB GHAURI

|

|

Najeeb

Ghauri

|

||

|

Chief

Executive Officer

|

||

|

Date: January

31, 2011

|

BY:

|

/S/ Boo-Ali Siddiqui

|

|

Boo-Ali

Siddiqui

|

||

|

Chief

Financial Officer

|

||

|

Principal

Accounting Officer

|

||

|

Date:

January 31, 2011

|

BY:

|

/S/ NAJEEB U. GHAURI

|

|

Najeeb

U. Ghauri

|

||

|

Chief

Executive Officer

|

||

|

Director,

Chairman

|

||

|

Date: January

31, 2011

|

BY:

|

/S/BOO-ALI SIDDIQUI

|

|

Boo-Ali

Siddiqui

|

||

|

Chief

Financial Officer

|

||

|

Principal

Accounting Officer

|

||

|

Date: January

31, 2011

|

BY:

|

/S/ SALIM GHAURI

|

|

Salim

Ghauri

|

||

|

President,

APAC

|

||

|

Director

|

||

|

Date: January

31, 2011

|

BY:

|

/S/ NAEEM GHAURI

|

|

Naeem

Ghauri

|

||

|

President,

EMEA

|

||

|

Director

|

||

|

Date: January

31, 2011

|

BY:

|

/S/ EUGEN BECKERT

|

|

Eugen

Beckert

|

||

|

Director

|

||

|

Date: January

31, 2011

|

BY:

|

/S/ SHAHID JAVED BURKI

|

|

Shahid

Javed Burki

|

||

|

Director

|

||

|

Date: January

31, 2011

|

BY:

|

/S/ MARK CATON

|

|

Mark

Caton

|

||

|

Director

|

||

|

Date: January

31, 2011

|

BY:

|

/S/ ALEXANDER SHAKOW

|

|

Alexander

Shakow

|

||

|

Director

|

|

Description

|

Page

|

|

|

Report

of Independent Registered Public Accounting Firm

|

F-2

|

|

|

Consolidated

Balance Sheets as of June 30, 2010 and 2009

|

F-3

|

|

|

Consolidated

Statements of Operations and Comprehensive Losses for the Years Ended June

30, 2010 and 2009

|

F-4

|

|

|

Consolidated

Statements of Stockholders’ Equity for the Years Ended June 30,

2010 and 2009

|

F-5

|

|

|

Consolidated

Statements of Cash Flows for the Years Ended June 30, 2010 and

2009

|

F-7

|

|

|

Notes

to Consolidated Financial Statements

|

F-9

|

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

Current

assets:

|

||||||||

|

Cash

and cash equivalents

|

$ | 4,075,546 | $ | 4,403,762 | ||||

|

Restricted

Cash

|

5,700,000 | 5,000,000 | ||||||

|

Accounts

receivable, net of allowance for doubtful accounts

|

12,280,331 | 11,394,844 | ||||||

|

Revenues

in excess of billings

|

9,477,278 | 5,686,277 | ||||||

|

Other

current assets

|

1,821,661 | 2,307,246 | ||||||

|

Total

current assets

|

33,354,816 | 28,792,129 | ||||||

|

Investment

under equity method

|

200,506 | - | ||||||

|

Property and equipment,

net of accumulated depreciation

|

9,472,917 | 9,186,163 | ||||||

|

Other

assets

|

- | 204,823 | ||||||

|

Intangibles:

|

||||||||

|

Product

licenses, renewals, enhancements, copyrights, trademarks, and tradenames,

net

|

19,002,081 | 13,802,607 | ||||||

|

Customer

lists, net

|

666,575 | 1,344,019 | ||||||

|

Goodwill

|

9,439,285 | 9,439,285 | ||||||

|

Total

intangibles

|

29,107,941 | 24,585,911 | ||||||

|

Total

assets

|

$ | 72,136,180 | $ | 62,769,026 | ||||

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current

liabilities:

|

||||||||

|

Accounts

payable and accrued expenses

|

$ | 4,890,921 | $ | 5,106,266 | ||||

|

Due

to officers

|

10,911 | - | ||||||

|

Current

portion of loans and obligations under capitalized leases

|

7,285,773 | 6,207,830 | ||||||

|

Other

payables - acquisitions

|

103,226 | 103,226 | ||||||

|

Unearned

revenues

|

2,545,314 | 3,473,228 | ||||||

|

Deferred

liability

|

47,066 | - | ||||||

|

Dividend

to preferred stockholders payable

|

- | 44,409 | ||||||

|

Convertible

notes payable , current portion

|

3,017,096 | - | ||||||

|

Loans

payable, bank

|

2,327,476 | 2,458,757 | ||||||

|

Total

current liabilities

|

20,227,783 | 17,393,716 | ||||||

|

Obligations under capitalized

leases, less current maturities

|

204,620 | 1,090,901 | ||||||

|

Convertible

notes payable less current maturities

|

4,066,109 | 5,809,508 | ||||||

|

Long term loans; less

current maturities

|

727,336 | 1,113,832 | ||||||

|

Lease

abandonment liability; long term

|

867,583 | - | ||||||

|

Total

liabilities

|