UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

NetSol Technologies, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. |

| ☒ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: |

| ☒ | Fee paid previously with preliminary materials: | |

| ☒ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

| 1) | Amount previously paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

NetSol Technologies, Inc.

https://netsoltech.com

April 13, 2023

Dear Fellow Shareholders,

I would like to take this opportunity to express my sentiments regarding the significant global business challenges in 2022. The instability in Europe and the war in Ukraine, global inflation, and supply chain challenges as well as the global macro environment provided us with some headwinds. These challenges, on top of the effects of COVID-19 from 2020 to early 2022, tested all of us as a Nation. I am proud of the strong work ethic and fundamentals demonstrated by all at NetSol during these global uncertainties and adversities, and I feel that our perseverance and development strategy will allow us to realize the full potential of the opportunities 2023 brings. I am excited and optimistic about our growth in the year ahead.

In the past year, our company has made considerable strategic progress enhancing its position across both existing and new geographic and solution offerings. NetSol has a market leading position in Asia, and we continue to be well positioned for sustained positive results in this region. We have built a substantial presence in Europe, and we relish a unique opportunity to build on this success; NetSol’s cloud and SaaS-based offerings continue to gain traction in this market, and we see this demand as an attractive opportunity to grow our recurring subscription and support-based revenues.

We are very pleased with the increase in our market share in the United States. NetSol has enhanced our marketing and sales activities in N. America within our core “Ascent Flagship Offering.” Newer verticals are also being launched by “AWS” for all U.S. markets as well as “Professional Services Offering” in U.S. and China.

I believe that these global efforts will result in enhanced profitability going forward, and I am pleased to report that our balance sheet is solid with a strong cash position. We remain committed to improving our operating performance and driving enhanced cash generation in FY 2023 and onwards. As part of that effort, we recently initiated a cost reduction initiative with a targeted annual cost savings of at least $4 million.

The Company’s new headquarters will be located at 16000 Ventura Blvd., Suite 770, Encino, CA 91436 as of April 17, 2023. I proudly invite all shareholders to join us at our annual meeting to be held on June 7, 2023, at the Company’s new headquarters; the meeting will begin promptly at 10:00 A.M., local time. As we do each year, we will address the voting items in the Proxy Statement and take any questions. Whether you plan to attend the meeting or not, your vote is important, and we encourage you to review the enclosed materials and vote whether it is via the Internet, by phone, by mail or in person. Thank you for voting.

The progress made in 2022 has positioned us for a solid start to date in 2023. I look forward to keeping you apprised of the Company’s progress, and on behalf of our employees, I thank you for your continued support and belief in NetSol.

Sincerely,

Najeeb Ghauri

Chairman and CEO

NetSol Technologies, Inc.

April 13, 2023

| Notice of Annual Meeting of Shareholders |  | ||

| AGENDA | |||

2022 Annual Meeting of Shareholders to be held: |

1 Election of five Director Nominees in this Proxy Statement. | ||

| DATE: | June 7, 2023 | 2 Advisory Vote to Approve Executive Compensation. | |

| TIME: | 10:00 a.m. local time | 3 Advisory Vote on Frequency of Future Shareholder votes on Named Executive Compensation. | |

| PLACE: | NetSol Technologies, Inc. | ||

| 16000 Ventura Blvd., | 4 Ratification of Appointment of BF Borgers CPA PC to serve as independent Auditors for Fiscal Year 2023. | ||

| Suite 770 | |||

| Encino, CA 91436 | 5 To Consider such other matters as may properly come before the Annual Meeting. | ||

| RECORD DATE: April 13, 2023 | |||

| VOTING MATTERS | |||

| Who May Vote: | |||

| If you owned shares of NetSol Common Stock at the close of business on April 13, 2023, you are entitled to receive this Notice of the 2022 Annual Meeting and to vote at the meeting, either in person or by proxy. | |||

| How to vote: | |||

| Please review this Proxy Statement and vote in one of the four ways shown under “Voting Methods Available to You” on the following page. | |||

By order of the Board of Directors NetSol Technologies, Inc. |

|||

Najeeb Ghauri

CEO and Chair of the Board

Calabasas, California

VOTING METHODS AVAILABLE TO YOU

|

Internet |

Visit the website identified in your proxy card. You will need the control number that appears on your proxy card when you access the web page.

|

Telephone |

If your shares are held in the name of a broker, bank or other nominee: follow the telephone voting instructions, if any, provided on your voting instruction card. If your shares are registered in your name: In the US call toll free: (800) 488-8075 and international callers please call either of our toll numbers, 201-806-7301 or 212-771-1133, and follow the telephone voting instructions. You will need the control number that appears on your proxy.

|

Sign, date and return your proxy card and return it in the enclosed postage pre-paid envelope.

| During the Meeting-In Person |

Attend the 2022 Annual Meeting in person at the Company’s headquarters and vote by Ballot. Please note, our new address for the meeting is 16000 Ventura Blvd., Suite 770, Encino, CA 91436.

TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE SIGN, DATE AND RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON. SHAREHOLDERS WHO ATTEND THE MEETING, MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF THEY DESIRE.

Table of Contents

| i |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on June 7, 2023. This Notice of the 2022 Annual Meeting of Shareholders and Proxy Statement, are available free of charge at www.proxyvote.com or at www.netsoltech.com/proxy. References in either document to our website are for the convenience of readers, and information available at or through our website is not part of, nor is it incorporated by reference in, the Proxy Statement.

The Board of Directors of NetSol Technologies, Inc. is soliciting proxies to be voted at our 2022 Annual Meeting of Shareholders on June 7, 2023, and at any postponed or reconvened meeting. We expect that the proxy materials or a notice of internet availability will be mailed and made available to shareholders beginning on or about April 15, 2023. At the meeting, votes will be taken on the matters listed in the Notice of 2022 Annual Meeting of Shareholders.

| Board recommendation | Page numbers | |||

| Proposal 1: Election of Directors | FOR each nominee | 11 | ||

| Proposal 2: Advisory Vote to Approve Executive Compensation | FOR | 12 | ||

| Proposal 3: Advisory Vote on Frequency of Future Shareholder Votes on Named Executive Officer Compensation | FOR one year | 13 | ||

| Proposal 4: Ratification of Appointment of BF Borgers CPA PC to Serve as the Company’s Independent Auditors For Fiscal Year 2023 | FOR | 14 |

| ii |

PROXY STATEMENT GENERAL INFORMATION

This Proxy Statement is furnished to holders of the common stock, par value $.01 per share, of NetSol Technologies, Inc., a Nevada corporation (the “Company” or “NETSOL”), in connection with the solicitation by the Company’s Board of Directors of proxies for use at the Company’s Annual Meeting of Shareholders (the “Annual Meeting”). For overnight accommodations Courtyard Los Angeles Sherman Oaks, located at 15433 Ventura Blvd., Sherman Oaks, CA 91403, telephone number is (818) 981-5400 is a 15-minute walk or a 0.8 miles drive from the Company and meeting site. The time and place of the Annual Meeting are stated in the Notice of Proxy Materials and the Notice of Annual Meeting of Shareholders that accompanies this proxy statement.

The Annual Meeting has been called for the purpose of the following:

| 1. | To consider and vote on the election of directors, each to hold office for a term of one year ending in 2024 or when their successors are elected. | |

| 2. | To approve, on an advisory basis, Named Executive Officer Compensation in this Proxy Statement (“Say-on- Pay”). | |

| 3. | To approve, on an advisory basis, of the Frequency of Future Advisory Shareholder votes on Named Executive Compensation (“Say on Frequency”). | |

| 4. | To consider and vote upon the ratification of the appointment of BF Borgers CPA PC as the Company’s independent auditors for the fiscal year 2023; and, | |

| 5. | To consider such other matters as may properly come before the Annual Meeting. |

QUESTIONS AND ANSWERS ABOUT VOTING AND THE SHAREHOLDER MEETING

| Q: | Why did I receive the proxy materials? |

| A: | We have made the proxy materials available to you over the internet and have mailed you notices of these materials because the Board is soliciting your proxy to vote your shares of our common stock at the annual meeting to be held on June 7, 2023, and at any adjournments or postponements of this meeting. |

| Q: | What is a proxy? |

| A: | The Board is asking you to give us your proxy. Giving us your proxy means that you authorize another person or persons to vote your shares of our common stock at the annual meeting in the manner you direct. The written document you complete to designate someone as your proxy is usually called a “proxy card” or a “voting instruction form” depending on how the ownership of your shares is reflected in our records. If you are the record holder of your shares, a “proxy card” is the document used to designate your proxy to vote your shares. If you hold your shares in street name, a “voting instruction form” is the document used to designate your proxy to vote your shares. In this proxy statement, the term “proxy card” means both the voting instruction form and proxy card unless otherwise indicated. |

Q: Who Can Vote?

| A: | You are entitled to notice of the Annual Meeting if you held any shares of common stock of NETSOL as of the close of business on the record date, April 13, 2023. You are entitled to vote at the Annual Meeting all shares of common stock of NETSOL that you held as of the close of business on that record date. Each share of common stock is entitled to one vote with respect to each matter properly brought before the Annual Meeting. |

As of April 13, 2023, there were 11,299,011 shares of common stock of NETSOL issued and outstanding.

In accordance with Nevada law, lists of our shareholders who are entitled to vote at the Annual Meeting will be available for inspection by any stockholder present at the Annual Meeting and, for ten days prior to the Annual Meeting, by any shareholder, for purposes germane to the meeting, at our offices located at 16000 Ventura Blvd., Suite 770, Encino, CA 91436. Any inspection of these lists prior to the Annual Meeting must be conducted between 9:30 A.M. and 4:30 P.M. (PST). Please contact our Corporate Secretary to arrange any inspection prior to the Annual Meeting.

| 1 |

| Q: | Who Is the Record Holder? |

| A: | You may own common stock either (1) directly in your name, in which case you are the record holder of such shares, or (2) indirectly through a broker, bank or other nominee, in which case such nominee is the record holder. |

If your shares are registered directly in your name, we will send these proxy materials directly to you. If the record holder of your shares is a nominee, you will receive proxy materials from such nominee.

| Q : | How Do I Vote? |

Record Holders:

| ● | By Mail. If you choose to vote by mail, mark your proxy card, date and sign it, and return it as soon as possible in the postage-paid envelope provided. | |

| ● | By Telephone. If you choose to vote by phone, please call toll free (800) 488-8075 and vote your shares; international callers please call either of our toll numbers 201-806-7301 or 212-771-1133 to vote. | |

| ● | By voting on the Internet. Please go on www.proxyvote.com. | |

| Stock Held by Brokers, Banks and Nominees: | ||

| ● | If your common stock is held by a broker, bank or other nominee, such nominee will provide you with instructions that you must follow in order to have your shares voted. | |

| Q: | Are proxy materials available on the Internet? |

| A: | Yes, please see notice below: |

Important notice regarding the availability of proxy materials

for the annual shareholder meeting to be held on June 7, 2023.

Our Proxy Statement and 2022 Annual Report are available on the following Web site:

http://ir.netsoltech.com/all-sec-filings

| Q: | What are NETSOL shareholders being asked to vote on at the annual shareholder meeting? |

| 2 |

| A: | You will vote on: |

Item 1: To consider and vote on the election of directors, each to hold office for a term of one year ending in 2024 or when their successors are elected.

Item 2: To approve, on an advisory basis, named executive officer compensation in this Proxy Statement (“Say-on- Pay”).

Item 3: To approve, on an advisory basis, of the frequency of future advisory shareholder votes on Named Executive Compensation.

Item 4: To consider and vote upon the ratification of the appointment of BF Borgers CPA PC as the Company’s independent auditors for the fiscal year 2023; and,

Item 5: To consider such other matters as may properly come before the Annual Meeting.

| Q: | How Many Shares Must be Represented in Order to Transact Business at the Annual Meeting? |

| A: | A quorum is the number of shares that must be represented, in person or by proxy, in order to transact business at the Annual Meeting. We will have a quorum and be able to conduct business at the Annual Meeting if a majority of the outstanding shares of common stock entitled to vote are present at the virtual meeting, either in person or by proxy. Abstentions will be included in the calculation of the number of shares considered to be present for purposes of determining whether a quorum is present. |

| Q: | How Many Votes Are Required to Approve a Proposal? |

| A: | If a quorum is present, the vote of a majority of votes presents in person or represented by proxy at the meeting and entitled to vote on the election of directors is required to elect directors. The vote of a majority of the votes cast is required to ratify the selection of our independent registered public accounting firm, and, to approve the proposal to approve, on an advisory basis, the named executive officer compensation in this Proxy Statement. |

| Q: | What is a Broker Non-Vote? |

| A: | Under the rules that govern nominees who have record ownership of shares that are held in “street name” for account holders (who are the beneficial owners of the shares), nominees typically have the discretion to vote such shares on routine matters, but not on non-routine matters. If a nominee has not received voting instructions from an account holder and does not have discretionary authority to vote shares on a particular item, a “broker non-vote” occurs. Shares that constitute broker non-votes with respect to a particular proposal will not be considered present and entitled to vote on that proposal at the Annual Meeting even though the same shares will be considered present for purposes of establishing a quorum and may be entitled to vote on other proposals. However, in certain circumstances, such as the appointment of the independent registered public accounting firm, the broker, bank, or other nominee has discretionary authority and therefore is permitted to vote your shares even if the broker, bank, or other nominee does not receive voting instructions from you. Election of directors and the advisory vote to approve the Company’s named executive officer compensation are not considered “routine” matters and as a result, your broker, bank, or other nominee will not have discretion to vote on these matters at the Annual Meeting unless you provide applicable instructions to do so. Therefore, we strongly encourage you to follow the voting instructions on the materials you receive. |

| Q: | What is the difference between holding shares as a “Shareholder of Record” and as a “Beneficial Owner”? |

| A: | If your shares are registered in your name on the books and records of American Stock Transfer and Trust Company, our registrar and transfer agent, you are a “Stockholder of Record” (also sometimes referred to as a “Registered Shareholder”). If you are a Shareholder of Record, we sent the Notice directly to you. |

| 3 |

If your shares are held by your broker or bank on your behalf, your shares are held in “Street Name” and you are considered a “Beneficial Owner.” If this is the case, the Notice has been sent to you by your broker, bank, or other holder of record.

| Q: | Does Anyone Solicit this Proxy and Who Will Pay the Expenses of the Proxy Distribution? |

| A: | We will pay the expenses for the preparation of the proxy materials and the solicitation of proxies. Our directors, officers or employees may solicit proxies on our behalf in person or by telephone, e-mail, facsimile or other electronic means. These directors, officers and employees will not receive additional compensation for such services. We have hired D.F. King to assist us in the solicitation of votes for approximately $7,000 plus any out-of-pocket expenses. In accordance with the regulations of the United States Securities and Exchange Commission (the “SEC”), we may reimburse brokerage firms and other custodians, nominees and fiduciaries for their out-of-pocket expenses incurred in sending proxies and proxy materials to beneficial owners of our common stock. |

| Q: | What do I need to do now? |

| A: | First, carefully read this document in its entirety. Then, vote your shares by following the instructions from your broker, if your shares are held in “street name”, or by one of the following methods: |

| ● | VOTE BY MAIL. If you requested the proxy materials to be sent to you by mail, please mark, sign, and date and return your proxy card in the enclosed return envelope as soon as possible; or | |

| ● | VOTE BY TELEPHONE. Call the toll-free number (800) 488-8075 or for international callers please call either of our toll numbers 201-806-7301 or 212-771-1133 to vote on the proxy card received by mail and follow the directions provided; or | |

| ● | VOTE BY INTERNET. Before the Annual Meeting go to www.proxyvote.com. This information is also listed on your proxy card mailed to you; or | |

| ● | BROKER VOTE. If a broker holds your shares in “street name,” you will need to get a legal proxy from your broker to vote in person at the meeting. |

Voting by phone or on the Internet has the same effect as submitting a properly executed proxy card.

| Q: | What are my choices when voting? |

| A: | When you cast your vote on: |

Item 1: You may vote in favor of electing the nominees as directors or vote against one or more nominees or you may abstain from voting.

Item 2: You may cast your vote in favor of or against the proposal, or you may elect to abstain from voting your shares.

Item 3: You may cast your vote in favor of “1 Year”, or “2 Years”, or “3 Years”; frequency, or you may elect to abstain from voting your shares.

Item 4: You may cast your vote in favor of or against the proposal, or you may elect to abstain from voting your shares.

| 4 |

If you sign, date and mail your proxy card without indicating how you want to vote, your proxy will be counted as a vote in favor of each director nominee in Proposal 1 and in favor of Proposal 2, in favor of One Year frequency for Proposal 3, and in favor of Proposal 4.

| Q: | Does the Board have a recommendation for voting? |

| A | The Board unanimously recommends you vote your shares as follows: |

Proposal 1- “FOR” each of the persons nominated for election to the Board.

Proposal 2- “FOR” To approve, on an advisory basis, named executive officer compensation in this Proxy Statement (“Say-on-Pay”).

Proposal 3- “FOR One Year” On an Advisory basis for the Frequency of Future Advisory Shareholder votes on Named Executive Compensation (“Say on Frequency”); and,

Proposal 4- “FOR” ratifying the selection of BF Borgers CPA PC as the Company’s independent auditor for fiscal year ending June 30, 2023.

| Q: | What if I abstain from voting? |

| A: | If your shares are represented at the annual meeting, in person or by proxy, but you abstain from voting on a matter, or include instructions in your proxy to abstain from voting on a matter, your shares will be counted for the purpose of determining if a quorum is present but will not be counted as either an affirmative vote or a negative vote with respect to that matter. With respect to the items scheduled to be voted on at the meeting, abstentions will have no effect on the outcome of the vote on those proposals, assuming a quorum is present. |

| Q | Who is eligible to vote? |

| A: | Holders of record of NETSOL common stock at the close of business on April 13, 2023, are eligible to vote at NETSOL’s Annual Meeting of Shareholders. As of April 13, 2023, there were 11,299,011 shares of NETSOL common stock issued and outstanding held by 139 holders of record, a number that does not include beneficial owners who hold shares in “street name”. |

| Q: | Why did I receive a notice in the mail regarding the Internet availability of the proxy material instead of a full set of printed proxy material? |

| A: | Pursuant to rules adopted by the SEC, we are making this Proxy Statement available to our Shareholders electronically via the Internet. On or about April 17, 2023, we will mail the Notice to Shareholders of our common stock at the close of business on the Record Date, other than those shareholders who previously requested electronic copy of our proxy materials, including this Proxy Statement and our 10K for fiscal year end, 2022. The Notice also contains instructions on how to request a paper copy of the Proxy Statement. We believe this process will provide you with the information you need in a timely manner, while conserving natural resources and lowering the costs of the Annual Meeting. |

| Q: | Can I vote my shares by filling out the Notice of Internet Availability of Proxy Materials? |

| A: | No. The Notice only identifies the items to be voted upon at the Annual Meeting. You cannot vote the Proposals by marking the Notice and returning it. The Notice provides instructions on how the cast the vote. |

| 5 |

| Q: | If my shares are held in “street name” by my broker, will my broker vote my shares for me? |

| A: | Yes, but only if you give your broker instructions. If your shares are held by your broker (or other nominee), you should receive this document and an instruction card from your broker. Your broker will vote your shares if you provide instructions on how to vote. If you do not tell your broker how to vote, your broker may vote your shares in favor of ratification of the auditor appointment but may not vote your shares on the election of directors or any other item of business. However, your broker is not required to vote your shares if you do not provide instructions. |

| Q: | Can I change or revoke my vote after I have mailed my signed proxy card or voted by telephone or electronically? |

| A: | Yes. If you have not voted through your broker, you can do this by: |

| ● | Calling the toll-free number on the proxy card at least 24 hours before the meeting and following the directions provided; or, | |

| ● | Going to the website listed on the proxy card at least 24 hours before the meeting and following the instructions provided; or, | |

| ● | Submitting a properly executed proxy prior to the meeting bearing a later date than your previous proxy. |

If you voted through your broker, please contact your broker to change or revoke your vote.

| Q: | Why did I receive more than one proxy card? |

| A: | You may receive multiple cards if you hold your shares in different ways (e.g. joint tenancy, in trust or in custodial accounts). You should vote on every proxy card that you receive. |

| Q: | How many shares are owned by NETSOL’s directors and executive officers? |

| A: | On April 13, 2023, NETSOL’s directors and executive officers beneficially owned 1,542,018 shares entitled to vote at the annual meeting, constituting approximately 11.71% of the total shares outstanding and entitled to vote at the meeting. |

| Q: | Where do I get more information? |

A: If you have questions about the meeting or submitting your proxy, or if you need additional copies of this document or the proxy card, you should contact the Company’s Corporate Secretary at (818) 222-9195.

Forward-Looking Statements & Website References

This Proxy Statement contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements include, but are not limited to, statements regarding the Company’s plans, objectives, expectations, and intentions. Such statements are based on current expectations and are subject to numerous risks and uncertainties, many of which are outside of the control of NETSOL. Actual results may differ materially from those indicated by such forward-looking statements as a result of risks and uncertainties, including those factors discussed or referenced in our most recent annual report on Form 10-K filed with the SEC, under the heading “Risk Factors,” a copy of which is being made available with this Proxy Statement, and subsequent quarterly reports on Form 10-Q. Website references and hyperlinks throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this Proxy Statement, nor does it constitute a part of this Proxy Statement.

| 6 |

BUSINESS OVERVIEW-2022 HIGHLIGHTS

We worked through tremendous challenges, including inflation headwinds, a strained supply chain, an extremely tight labor market and Russia’s invasion of Ukraine. Despite these many challenges, this past year confirmed that our focused portfolio, our superior technical capabilities and our talented workforce provide us with an edge in the industry. We’ve strived to maintain our commitments to our customers and communities, and we’ve built a backlog that supports our position as an industry leader. In fiscal 2022, NETSOL performance was impacted by the challenges our business faced as a result of the global COVID-19 pandemic. As we adapted, gradually we were able to service customers and clients remotely. With the steady recovery of our business globally, we accelerated our plans to transform our business to meet customers’ evolving preferences in the new environment and position the Company for long-term success.

A few of our highlights for the fiscal year ended June 30, 2022 were:

| ● | We generated approximately $5,500,000 of revenue by successfully implementing change requests from various customers across multiple regions. | |

| ● | We went live with NFS Ascent® and NFS Ascent® Digital in New Zealand for a leading Japanese equipment manufacturer and in addition signed a statement of work which will generate approximately $1,000,000 of revenue. | |

| ● | We went live in Japan, Australia, and South Africa with various NFS Ascent® and NFS implementations with Daimler Truck Financial Services GmbH (“DTFS”). These implementations were on time as per requirements of the Clients. The implementations will generate over $4,000,000 in revenues including license revenue, services revenue, and support revenue. | |

| ● | We renegotiated a support contract with DFS which will generate over $10,000,000 on top of the previously projected revenues from the same contract, to be recognized over the next four years. | |

| ● | We renegotiated the support contract with BMW in China to additionally generate approximately $400,000 above the previously expected revenues. | |

| ● | We signed a contract with a commercial finance organization in Australia, which is part of a bigger finance network, to implement NFS Ascent®. This SaaS implementation is expected to generate approximately $500,000 in subscriptions and services over the next five years. | |

| ● | We progressed to the UAT stage in the implementation process of our NFS Ascent® Suite for DFS in India. | |

| ● | We entered into a strategic partnership with CGI in a bid to gain further traction in Europe. This partnership is expected to not only expand the current business pipeline in Europe but will also help in successfully delivering future SaaS implementations across Europe and other regions. | |

| ● | We signed a contract with a notable Swedish bank to implement NFS Ascent® in Sweden, Norway, Denmark and Finland with an estimated value of $5,000,000 over the five-year contract period. | |

| ● | We successfully implemented our modern technology platform Ascent® on the Cloud (LeasePak Version) for a leading North American lease and loan portfolio servicing provider. The client has deployed Ascent® Retail’s Contract Management System (CMS) on the Cloud. The organization plans to generate approximately $2,000,000 from this contract over a 5-year period. | |

| ● | We successfully went live with our cloud-based NFS Ascent® Retail Platform for a bank in the United Kingdom. The Retail Platform constitutes both NFS Ascent® Omni Point of Sale and NFS Ascent® Contract Management System. This contract will provide additional subscription fee of approximately $1,000,000 over the coming 5 years. |

| 7 |

| ● | We successfully upgraded our front-end solution currently deployed at a leading bank of Japan based in Indonesia. This upgrade helped the business generate close to $500,000. | |

| ● | We onboarded another 20 dealers of a leading German Auto Manufacturer in the U.S, on our digital retailing solution Otoz. | |

| ● | We were awarded a Five-Star Premier Business Partnership Level Status with the American Financial Services Association. |

Marketing and Business Development Activities

Management has developed a growth strategy aimed at increasing competitiveness, enhancing global delivery capabilities and increasing financial strength to become a leading global IT institution in the leasing and finance space.

The growth strategy contemplates the following enhanced activities and initiatives to accomplish these goals:

| ● | Build strong C-level executive professional teams in each key location to execute our long-term strategy. | |

| ● | Develop, groom, and retain the next tier level management for leadership to navigate long term growth. | |

| ● | Upgraded our offices in China to support the growing and existing client relationships and new client acquisitions in the region. | |

| ● | Further penetration of NFS Ascent® into the leasing and financing sectors in China, APAC, Europe and North America by focusing on multi-national auto captive Fortune 500 companies. | |

| ● | Pursue a well thought out strategy to diversify into complimentary verticals by way of organic expansion, partnerships and synergistic M&A. | |

| ● | Continue to implement new tools, systems and processes, such as JIRA, and the Agile framework to further enhance productivity, efficiencies and operating margins. | |

| ● | Offer a cloud enabled NFS Ascent® at subscription-based pricing models to generate additional interest from prospects. | |

| ● | Continue investing in our innovation lab to generate new verticals for the business. |

We are taking sweeping actions to transform our business to preserve liquidity, sustain key investments, improve performance, and position the Company to be more productive and competitive as the automotive industry rapidly changes. This ongoing effort involves a thorough review of our business, with numerous key transformational projects throughout every subsidiary.

As we transform our business, we are working to reshape our infrastructure, streamline our overhead and organizational structure, strengthen the health of our pipeline and demand operational excellence into every corner of our business.

| 8 |

Some of the key 2022 actions included the following:

Infrastructure |

We added Tianjin subsidiary in China to have more of a Chinese presence. The full name of the subsidiary is Tianjin NuoJinZhiCheng Co., Ltd. We expanded our footprint by offering Amazon Web Services. R&D to include AI and machine learning solutions. | |

|

Overhead and Organization |

Critically evaluating cost structure, and how we operate and are organized, with an eye toward simplification and provide leadership in global operations. | |

Pipeline Health |

Carefully managing pipeline while recalibrating potential customers, while improving efficiency, quality, and cost performance. We continue to implement new tools, systems and processes, such as JIRA and Agile Framework to further enhance productivity. We offer cloud enablers for NFS Ascent at subscription based priced models to generate additional interest from prospects. | |

|

Operational Excellence |

Strengthening every aspect of operational excellence to improve performance, enhance quality and reduce redundancies. Even with the Covid-19 limitations, our teams recalibrated and remotely went live. NETSOL continues to enjoy 100% implementation success rate worldwide. | |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE HIGHLIGHTS

For decades, NETSOL’s innovations and products have helped transform leasing and finance industries. We believe in the power of technology for the greater good.

Responsible Business.

We integrate responsible and sustainable practices throughout our organization. Our products are services oriented and designed, to not harm individuals, communities, or the environment. Because privacy and security are critical for success in the technologies industry, we constantly seek to promote data protection across all our implementation processes.

Environmental Sustainability.

We work to be a positive force in protecting the environment by continually looking for ways to conserve water, reduce waste, recycle, and minimize energy consumption. As we repurpose our workspaces and operate our global offices more efficiently, we focus on our environmental impact. Having our headquarters located in Southern California, we are at the epicenter of fires that remind us of environmental sustainability is an everyday phenomenon. Globally, all our offices have developed and implemented recycling, reducing waste and no plastics office space. All employees are encouraged to contribute to a safe and responsible work environment.

PEOPLE AND CULTURE

We believe we have developed a strong corporate culture that is critical to our success. Our key values are delivering world-class quality software, client-focused timely delivery, leadership, long-term relationships, creativity, openness and transparency and professional growth. The services provided by NETSOL require proficiency in many fields, such as software engineering, project management, business analysis, technical writing, sales and marketing, and communication and presentation skills.

Due to the growing demand for our core offerings and IT services, retention of technical and management personnel is essential. Our employee turnover was under 16.04 % in 2022. In addition, we are committed to improving key performance indicators such as efficiency, productivity and revenue per employee. To encourage all employees to build on our core values, we reward teamwork and promote individuals that demonstrate these values. We believe that our growth and success are attributable in large part to the high caliber of our employees and our commitment to maintain the values on which our success has been based. We support gender diversity on a global basis. We are an equal opportunity employer with the largest concentration of female employees in Lahore, Pakistan and our U.S. headquarters.

| 9 |

There is significant competition for employees with the skills required to perform the services we offer. We run an elaborate training program for different cadres of employees to cover technical skills and business domain knowledge, as well as communication, management and leadership skills. We believe that we have been successful in our efforts to attract and retain the highest level of talent available, in part because of the emphasis on core values, training and professional growth. We intend to continue to recruit, hire and promote employees who share our vision.

As of June 30, 2022, we had approximately 1,781 employees; comprised of 80.4 % technical staff and 19.6 % non-IT personnel. Our 80% technical staff are software engineers, programmers, project managers, quality assurance, sales, pre-sales, business development, dedicated employees to core NFS™ and NFS Ascent®. None of our employees are subject to a collective bargaining agreement.

Diversity and Inclusion. We believe that our growth and success are attributable in large part to the high caliber of our employees and our commitment to maintain the values on which our success has been based. We believe that a diverse workforce is critical to our success, and we continue to focus on the hiring, retention and advancement of women and underrepresented populations. Having offices in the U.S., Asia Pacific, and Europe, NETSOL is proud of its wide range of diverse people in its workforce. Our female workforce overall in the Company is 20%. We provide transportation, daycare support, meal support and after school care support at our Technology Campus in Lahore, Pakistan. Some Lahore employees also receive free medical care. These additional reinforcements are especially important to continue building our female workforce at the Lahore Campus. Furthermore, we offer flexible work schedules to all our employees. providing them with WFH opportunities. All employees, male and female, have access to gym facilities in our Pakistan and U.S. offices promoting the health and wellness of our staff.

Giving Back to the Community. NETSOL believes it should give back to the community and employees as much as possible. Certain subsidiaries of NETSOL are located in regions where basic services are not readily available. Where possible, NETSOL acts to not only improve the quality of life of its employees, but also the standard of living in these regions. Examples of such programs are as follows:

| ■ | In the U.S. we have established NetSol Foundation, a 501(c)(3), where the Company and employees contribute to help various charitable causes locally and globally. | |

| ■ | Literacy Program: Launched to educate children of our unskilled staff, the main objective of this program is to enable them to acquire basic reading, writing and arithmetic skills.

| |

| ■ | Higher Education and Science and Research Institutions: In order to support higher education in Pakistan, we have contributed endowments to NUST, Forman Christian College, and a few other universities who are focused on science and engineering. | |

| ■ | Noble Cause Fund: A noble cause fund has been established to meet medical and education expenses of the children of the lower paid employees. Our employees voluntarily contribute a fixed amount every month to the fund and NETSOL matches the employee subscriptions with an equivalent contribution amount. A portion of this fund is also utilized to support social needs of certain institutions and individuals, outside of NETSOL. | |

| ■ | Preventative Health Care Program: In addition to the comprehensive out-patient and in-patient medical benefits, preventive health care has also been introduced in our Lahore offices. This phased program focuses on vaccination of our employees against such diseases as Hepatitis – A/B, Tetanus, Typhoid, Flu and COVID-19 on a routine basis. |

| 10 |

ANNUAL MEETING BUSINESS

NETSOL’s articles of incorporation and bylaws provide that directors are elected to serve a one-year term of office, expiring at the next annual meeting of shareholders. Our articles of incorporation establish up to nine directors, with the exact number to be fixed from time to time by resolution of the Board of Directors.

Directors are elected by a majority of votes, which means that the nominees receiving the most votes will be elected. Shareholders are not entitled to cumulate votes in the election of directors. In determining the votes cast for the election of a director, abstentions and broker non-votes are excluded. The Nominating and Corporate Governance Committee considers the offer of resignation and recommends to the Board whether to accept it. The policy requires the Board to act on the Nominating and Corporate Governance Committee’s recommendation within 90 days following the shareholder meeting. Board action on the matter requires the approval of a majority of the independent directors.

The Board of Directors has nominated the following directors for election to one-year terms that will expire at earlier of their removal or replacement or at the 2023 annual meeting:

Najeeb Ghauri

Mark Caton

Malea Farsai

Michael Francis

Kausar Kazmi

The individuals appointed as proxies intend to vote “FOR” the election of the nominees listed above. If any nominee is not available for election, the individuals named in the proxy intend to vote for such substitute nominee as the Board of Directors may designate. Each nominee has agreed to serve on the board and we have no reason to believe any nominee will be unavailable.

For the biography of each nominee as well as for Director Compensation, please refer to Page 30 of the Proxy.

Board Recommendation:

|

The Board of Directors recommends shareholders vote “FOR” the election of each of the five director nominees. |

| 11 |

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

A “Say-on-Pay” advisory vote is required for all U.S. public companies under Section 14A of the Securities Exchange Act of 1934, as amended. In accordance with this law, we are asking shareholders to approve, on an advisory basis, the compensation of the Company’s named executive officers disclosed in the Compensation Discussion and Analysis section on page 32, This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers and the philosophy, policies and practices described in this proxy statement.

For the reasons discussed below, the Board of Directors recommends that you vote FOR approval of the advisory vote on named executive officer compensation because it believes that the policies and practices described in the Compensation Discussion and Analysis are effective in achieving the Company’s goals of rewarding sustained financial and operating performance and leadership excellence, aligning the executives’ long-term interests with those of the shareholders and motivating the executives to remain with the Company for long and productive careers. Named executive officer compensation of the past three years reflects amounts of cash and long-term equity awards consistent with periods of economic stress and lower earnings, and equity incentives aligning with our actions to stabilize the Company and to position it for a continued recovery.

We urge shareholders to read the Compensation Discussion and Analysis beginning on page 32 of this proxy statement, as well as the Summary Compensation Table and related compensation tables, notes and narrative, appearing on pages 39 through41, which provide detailed information on the Company’s compensation policies and practices and the compensation of our named executive officers.

Vote Required

Approval of the advisory vote on named executive officer compensation requires the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy and entitled to vote at the meeting. While this advisory vote on named executive officer compensation is non-binding, the Board and the Compensation Committee will review and consider the voting results when evaluating our executive compensation program. Currently, the Board seeks the shareholders vote on Named Executive Officer Compensation every year. The next time the shareholders have an opportunity to vote on this matter is on the proxy for fiscal year 2023.

Board Recommendation

|

THE COMPANY’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION. |

| 12 |

ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY SHAREHOLDER VOTES ON EXECUTIVE COMPENSATION.

Pursuant to Section 14A of the Exchange Act, we are asking shareholders to vote on whether future advisory votes on executive compensation of the nature reflected in Proposal Number 2 above should occur every year, every two years, or every three years. The Company has had annual votes starting with the 2012 annual meeting, following the advisory vote of shareholders in favor of annual “say on pay” votes, which was reaffirmed at the Company’s 2017 annual meeting.

While the Company’s executive compensation programs are designed to promote a long-term connection between pay and performance, the board recognizes that executive compensation disclosures are made annually. Holding an annual advisory vote on executive compensation provides the Company with more direct and immediate feedback on our compensation disclosures. We believe that an annual advisory vote on executive compensation is consistent with our practice of seeking input and engaging in dialogue with our shareholders on corporate governance matters (including the Company’s practice of having all directors elected annually and annually providing shareholders the opportunity to ratify the Audit Committee’s selection of independent auditors) and our executive compensation philosophy, policies and practices.

Although the vote is non-binding, the board will consider the vote results in determining the frequency of future say-on-pay votes. The Company will announce its decision on the frequency of say-on-pay votes in a Form 8-K filed with the SEC no later than 150 days after the Annual Meeting. Notwithstanding the board’s recommendation and the outcome of the shareholder vote, the board may in the future decide to conduct advisory votes on a more or less frequent basis and may vary its practice based on factors such as discussions with shareholders and the adoptions of material changes to compensation programs.

Board Recommendation

|

THE COMPANY’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EVERY “1 Year” AS THE FREQUENCY WITH WHICH THE COMPANY SHOULD PROVIDE ITS SHAREHOLDERS WITH ADVISORY VOTE ON EXECUTIVE COMPENSATION. |

| 13 |

RATIFICATION OF APPOINTMENT OF BF BORGERS CPA PC AS THE COMPANY’S INDEPENDENT AUDITOR FOR FISCAL YEAR 2023

The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of the Company’s independent registered public accounting firm. The Audit Committee engages in an annual evaluation of the independent public accounting firm’s qualifications, assessing a wide variety of factors.

The Audit Committee has appointed BF Borgers CPA PC (“Borgers CPA”) to audit and review NETSOL’s financial statements since 2020. A majority of the votes cast, in person or by proxy, at the Annual Meeting, is required for the ratification of the appointment of the independent registered public accounting firm. Should the shareholders not ratify the selection of Borgers CPA, it is contemplated that the appointment of Borgers CPA will be permitted to stand unless the Audit Committee finds other compelling reasons for making a change. Disapproval by the shareholders will be taken into consideration for the selection of the independent registered public accounting firm for the coming year.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Audit Fees

BF Borgers audited the Company’s financial statements for the fiscal year ended June 30, 2022 and 2021. The aggregate fees billed by principal accountants for the annual audit and review of financial statements included in the Company’s Form 10-K, services related to providing an opinion in connection with our public offering of shares of common stock and/or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements was $250,000 for the years ended June 30, 2022, and 2021.

Tax Fees

Tax fees for fiscal year 2022 were $13,000 and consisted of the preparation of the Company’s federal and state tax returns for the fiscal years 2021. Tax fees for fiscal year 2021 were $13,000 and consisted of the preparation of the Company’s federal and state tax returns for the fiscal year 2020.

All Other Fees

No other fees were paid to principal accountant during the fiscal year 2022 and 2021.

Pre-Approval Procedures

The Audit Committee and the Board of Directors are responsible for the engagement of the independent auditors and for approving, in advance, all auditing services and permitted non-audit services to be provided by the independent auditors. The Audit Committee maintains a policy for the engagement of the independent auditors that is intended to maintain the independent auditor’s independence from NETSOL. In adopting the policy, the Audit Committee considered the various services that the independent auditors have historically performed or may be needed to perform in the future. The policy, which is to be reviewed and re-adopted at least annually by the Audit Committee:

(i) Approves the performance by the independent auditors of certain types of service (principally audit-related and tax), subject to restrictions in some cases, based on the Committee’s determination that this would not be likely to impair the independent auditors’ independence from NETSOL;

(ii) Requires that management obtain the specific prior approval of the Audit Committee for each engagement of the independent auditors to perform other types of permitted services; and

| 14 |

(iii) Prohibits the performance by the independent auditors of certain types of services due to the likelihood that their independence would be impaired.

Any approval required under the policy must be given by the Audit Committee, by the Chairman of the Committee in office at the time, or by any other Committee member to whom the Committee has delegated that authority. The Audit Committee does not delegate its responsibilities to approve services performed by the independent auditors to any member of management.

The standard applied by the Audit Committee in determining whether to grant approval of an engagement of the independent auditors is whether the services to be performed, the compensation to be paid therefore and other related factors are consistent with the independent auditors’ independence under guidelines of the Securities and Exchange Commission and applicable professional standards. Relevant considerations include, but are not limited to, whether the work product is likely to be subject to, or implicated in, audit procedures during the audit of NETSOL’s financial statements; whether the independent auditors would be functioning in the role of management or in an advocacy role; whether performance of the service by the independent auditors would enhance NETSOL’s ability to manage or control risk or improve audit quality; whether performance of the service by the independent auditors would increase efficiency because of their familiarity with NETSOL’s business, personnel, culture, systems, risk profile and other factors; and whether the amount of fees involved, or the proportion of the total fees payable to the independent auditors in the period that is for tax and other non-audit services, would tend to reduce the independent auditors’ ability to exercise independent judgment in performing the audit.

Summary of Fees

| Fiscal Year | Fiscal Year | |||||||

| Ended | Ended | |||||||

| June 30, | June 30, | |||||||

| 2022 | 2021 | |||||||

| Audit Fees | $ | 250,000 | $ | 250,000 | ||||

| Audit-Related Fees | - | - | ||||||

| Tax Fees | $ | 13,000 | $ | 13,000 | ||||

| All other Fees | - | - | ||||||

| Total | $ | 263,000 | $ | 263,000 | ||||

Board Recommendation:

|

THE COMPANY’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF BF BORGERS CPA PC AS INDEPENDENT AUDITOR FOR FISCAL YEAR 20223. |

| 15 |

CORPORATE GOVERNANCE, BOARD OF DIRECTORS

Nomination of Directors:

The Board is responsible for nominating members to the Board and for filling vacancies on the Board that may occur between annual meetings of shareholders, in each case based upon the recommendation of the Nominating and Corporate Governance Committee. This committee seeks input from other Board members and senior management to identify and evaluate nominees for director. The committee may hire a search firm or other consultants. The committee will consider nominees recommended by shareholders for election to the Board provided the names of such nominees, accompanied by relevant biographical information, and relevant information about the shareholder submitting the nominee, are provided in writing to our secretary in accordance with the requirements of our bylaws.

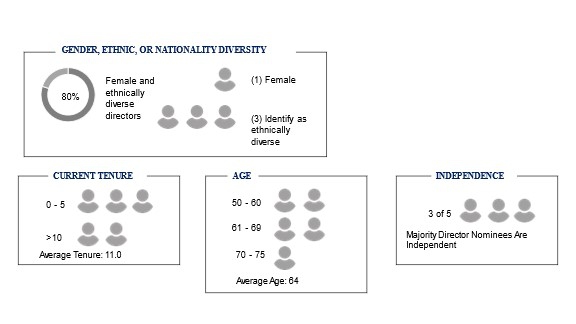

In furtherance of ongoing board refreshment, the Nominating and Corporate Governance Committee is committed to ensuring that it remains composed of directors who are equipped to oversee the success of the business, striving to maintain an appropriate balance of diversity, skills, and tenure in its composition, and intends to continue its board refreshment over the next few years. This year, the Nomination and Corporate Governance Committee Chairperson, Henry Tolentino, will not stand for re-election due to personal reasons. In his place, Mr. Michael Francis has been nominated as an independent board nominee.

The Committee has nominated five director nominees to stand for election at the Annual Meeting. Four of the Five nominees are current directors. Three of the nominees are independent directors.

Director Independence:

The Board has determined that independent directors must have no material relationship with the Company, based on all material facts and circumstances. At a minimum, an independent director must meet each of the standards listed below.

| 1. | The director, within the last three years, has not been employed by and has no immediate family member that has been an executive officer of the Company. | |

| 2. | Neither the director nor any immediate family member has, in any 12-month period during the last three years, received more than $120,000 in direct compensation from the Company other than compensation for director or committee service and pension or other deferred compensation for prior service. | |

| 3. | Neither the director nor any immediate family member is a current partner of the Company’s independent accountants firm, the director is not a current employee of the independent accountant’s firm, no immediate family member is a current employee of the independent accountant’s firm working in its audit, assurance or tax compliance practice, and neither the director nor any immediate family member was an employee or partner of the independent accountant’s firm within the last three years and worked on the Company’s audit within that time. | |

| 4. | Neither the director nor any immediate family member has, within the last three years, been part of an interlocking directorate. This means that no executive officer of the Company served on the compensation committee of a company that employed the director or an immediate family member. | |

| 5. | The director is not currently an employee of and no immediate family member is an executive officer of another company that represented at least 2% or $1 million, whichever is greater, of the Company’s gross revenues, or of which the Company represented at least 2% or $1 million, whichever is greater, of such other company’s gross revenues in any of the last three fiscal years. Charitable contributions are excluded from this calculation. |

For the purposes of these standards, “Company” includes all NETSOL subsidiaries and other affiliates. “Immediate Family Member” includes the director’s spouse, domestic partner, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law. The independence standards for the members of the Audit Committee provide that, in addition to the foregoing standards, they may not receive any compensation other than director’s fees for Board and Audit Committee service and permitted retirement pay or be an “affiliate” of the Company apart from their capacity as a member of the Board as defined by applicable SEC rules.

| 16 |

The Common Stock is listed and traded on the NASDAQ Capital Market. The corporate governance rules of the NASDAQ Capital Market require that a majority of the Board consist of directors who are “independent” of the Company. The Board has determined each of the following directors and nominees for director qualify as “independent” in accordance with Rule 5605(a)(2)(A) and (B) of the NASDAQ listing standards for determining independence. Messrs. Mark Caton, Henry Tolentino, Michael Francis, and Syed Kausar Kazmi are independent Board members or nominee as described in the listing standards.

Annually, the Nominating and Corporate Governance Committee reviews all nominations for independent board members. As Mr. Tolentino is not standing for re-election due to personal reasons, the Committee considered a new independent nominee. The Committee nominated Mr. Michael Francis as the most qualified. In addition to over 30 years of financial services industry experience, Mr. Francis is well versed in leading large businesses internationally as well as the intricacies of the banking industry. Mr. Francis served as an interim executive director of VLS, a subsidiary of NTE, for a period of six months starting in November 2022 and ending in April 2023, to utilize his Financial Conduct Authority (FCA) authorization to assist in the strategic management of VLS and to meet VLS’s FCA requirements. He has no involvement in the day to day business operation of the VLS or NetSol. NASDAQ rules permit an individual who has been acting as an executive on an interim basis for under a year to serve as an independent director provided that the board and nomination committee have determined that his role with, in this case, VLS, does not otherwise pose a conflict of interest with serving as an independent director. The Board and Nomination Committee find Mr. Francis’s temporary role with VLS does not result in a conflict with his ability to make independent decisions at the Company level and unanimously support his nomination to the Board as an independent director.

Our Board Leadership Structure

Why our Board leadership structure is right for NETSOL

Our Board and Nomination and Corporate Governance Committee regularly review and evaluate the Board’s leadership structure. Mr. Najeeb Ghauri serves as both NETSOL’s CEO and Chair of the Board, which the Board has determined is the most appropriate and effective leadership structure for the Board and the Company at this time. Mr. Ghauri has served in this dual capacity since 2006 and brings over 16 years of strategic leadership experience and an unparalleled knowledge of NETSOL’s business, operations and risks to his role as Chair of the Board. Currently, as a small-cap global corporation, the combination of these two positions is the most appropriate and suitable structure for a proper, efficient and cost-effective Board functioning and communication. Mr. Najeeb Ghauri is the direct link between senior management globally and the Board members and provides critical insight to the Board, as well as feedback to senior management through his comprehensive understanding of the issues at hand. Mr. Ghauri’s travels and visits to all subsidiaries across the globe, holding meetings with heads of each subsidiary and relaying the important aspects of such meetings to the Board, justify the need for Mr. Ghauri to hold his dual leadership position. To provide the Board with autonomy, the Board maintains majority independent members whom all head and participate exclusively in all Board committees. The CEO makes quarterly reports to the Board of Directors and answers questions posed by Directors. He also discusses with the Board the reasons for certain recommendations of the Company’s executive management group.

The Board does not have a policy on whether the roles of the Chair and CEO should be separated but believes the current combination of the two roles provides NETSOL with, among other things, a clear and effective leadership structure to communicate the Company’s business and long-term strategy to its customers, shareholders and the public. The combined Chair-CEO structure also provides for robust and frequent communication between the Board’s independent directors and the management of the Company. Recently, having Mr. Najeeb Ghauri in the dual role was extremely effective as rapid, clear, decisive decisions were made in the midst of the global Covid-19 pandemic and its aftermath affecting all of NETSOL’s subsidiaries.

Board Composition and Refreshment

We believe the Board benefits from a mix of new directors who bring fresh perspectives and longer-serving directors, who bring valuable experience, continuity, and a deep understanding of the Company. The Board strives to maintain an appropriate balance of tenure, turnover, diversity, skills and experience. To promote thoughtful Board refreshment, we have:

| ü | Developed a comprehensive, ongoing Board succession planning process; | |

| ü | Implemented an annual Board and Committee assessment process; and | |

| ü | Look to our Advisory Board for input and critique. |

The average age of our Director nominees and our Independent Director nominees is 64 years and 66 years respectively.

Throughout the director selection and nomination process, the Nominating and Corporate Governance Committee and the Board seek to achieve diversity within the Board with various viewpoints, perspectives and expertise that are representative of our global business. Once elected, the Directors periodically visit NETSOL’s operations, globally. This provides the Directors with an opportunity to see firsthand the execution and impact of the Company’s strategy and engage with senior leaders and associates in our subsidiaries to deepen their understanding of NETSOL’s business, competitive environment and corporate culture.

| 17 |

In his third year as the Audit Committee Chair, Mr. Kazmi offers a breadth of experience in finance and banking industry as head of commercial banking and business development with Habib Bank Zurich PLC, UK. He is well versed in finances and is providing valuable insight to the audit committee.

NETSOL continues to obtain diverse viewpoints and experiences from various ages, gender, business backgrounds that come together from various parts of the world to form the Board of Directors of NETSOL.

There are five members of the Board of Directors; however, the three independent members serve on the key Board Committees.

Role of Board in Oversight of Risks:

Our Board is actively involved in the oversight of risks that could affect the Company. In this regard, the Board seeks to understand and oversee the most critical risks relating to our business both internally and externally, the Board allocates responsibilities for the oversight of risks among the full Board and its committees, and reviews the systems and processes that management has in place to manage the current risks facing the Company, as well as those that could arise in the future. The Board recognizes that the Company’s business risk is not static, and that it is not possible to mitigate all risk and uncertainty. The Board does not have a standing risk management committee but administers this oversight function directly through the Board as a whole, as well as through Committees of the Board.

For example, the Audit Committee assists the Board in its risk oversight function by reviewing and discussing with management our accounting principles, financial reporting practices and system of disclosure controls and internal controls over financial reporting. The Nominating and Corporate Governance Committee assist the Board in its risk oversight function by periodically reviewing and discussing with management important corporate governance principles and practices and by considering risks related to our director nominee evaluation process and legacy. This Committee also ensures that the Company maintains a positive and effective Board leadership and is up to date with internal policies such as the Company’s Code of Ethics. The Compensation Committee assists the Board in its risk oversight function by considering risks relating to the design of our executive compensation programs and arrangements. The full Board receives updates from the company’s Senior Manager of Information and Risk Security. The Manager provides the Board with information and updates on the processes and procedures for Cybersecurity. The Board as a whole considers strategic risks and opportunities and receives reports from the committees regarding risk oversight in their areas of responsibility as necessary.

The Company believes the Board leadership structure facilitates the division of risk management oversight responsibilities among the Board committees and enhances the Board’s efficiency in fulfilling its oversight function with respect to different areas of our business risks and our risk mitigation practices. The Board of Directors and the management team are committed to continuous improvement and strengthening of the Company’s risk management practices.

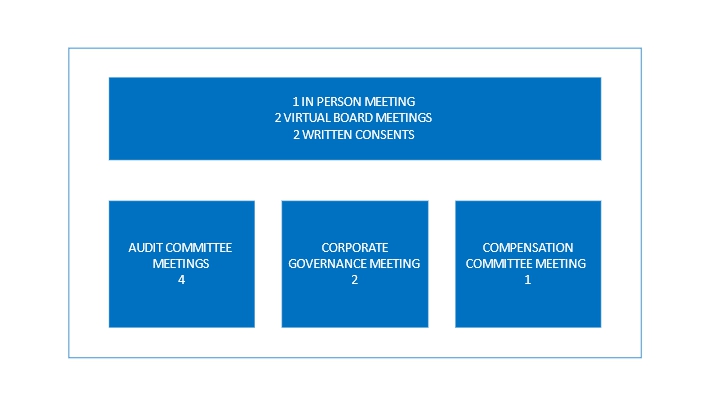

FISCAL YEAR 2022 MEETING SUMMARY

Board of Directors Meetings:

During the fiscal year ended June 30, 2022, the Board of Directors of the Company met in person one time and virtually two times. The Board also acted by written consent two times at which all Directors were available to vote unanimously. The Company requests that all Board members attend annual meetings of the Board, however, it is not mandatory.

| 18 |

Strategy and Business Plan Reviews

Annually, the Board holds an offsite meeting with senior management to review the strategy and long-range plans for each of our businesses and to discuss other topics, such as key Company areas of focus, succession and risks.

Board Committees:

The Board of Directors of the Company has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The charters for the Audit, Compensation and Nominating and Corporate Governance Committees are posted on the Company’s web site at www.netsoltech.com and may be viewed here. All committee members are appointed by the Board of Directors and only Independent Board members serve on these committees.

The Audit Committee met four times, the Compensation Committee met one time, and the Nominating and Corporate Governance Committee met two times during fiscal year 2022.

Committee Members:

The Audit Committee is made up of Mr. Kazmi as Chair, Mr. Caton, and Mr. Tolentino as members. The Compensation Committee consists of Mr. Caton as its Chair, Mr. Kazmi and Mr. Tolentino as its members. The Nominating and Corporate Governance Committee consists of Mr. Tolentino as Chair, Mr. Caton and Mr. Kazmi as members.

| 19 |

The table below provides the membership for each of the committees during Fiscal Year 2022.

| Nominating and | ||||||

| Corporate | ||||||

| Audit | Compensation | Governance | ||||

| Director | Committee | Committee | Committee | |||

| Najeeb Ghauri (Chair of the Board) | ||||||

| Malea Farsai | ||||||

| Mark Caton (I) | X | X (C) | X | |||

| Kausar Kazmi (I) | X (C) | X | X | |||

| Henry Tolentino (I) | X | X | X (C) |

The Company has an Audit Committee whose members are the independent directors of the Company. Mr. Kazmi as Chair, and Mr. Caton and Mr. Tolentino as members.

The Audit Committee met four times remotely during fiscal 2022. The Audit Committee was established by the Board for the purpose of overseeing the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements and reviewing the financial reports and other financial information provided by the Company to any governmental body or the public and the Company’s systems of internal controls regarding finance, accounting, legal compliance, and ethics. Its primary duties and responsibilities are to: (i) serve as an independent and objective party to monitor the Company’s financial reporting process, audits of the Company’s financial statements, and the Company’s internal control system and (ii) appoint from time to time, evaluate, and, when appropriate, replace the registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company, determine the compensation of such “outside auditors” and the other terms of their engagement, and oversee the work of the outside auditors. The Company’s outside auditors’ report directly to the Audit Committee. The Audit Committee is also charged with establishing procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. In summary, the Audit Committee is generally responsible for:

| ● | Appointing, compensating, retaining and overseeing NETSOL’s independent registered public accounting firm. | |

| ● | Reviewing the annual report of NETSOL’s independent registered public accounting firm related to quality control. | |

| ● | Reviewing NETSOL’s annual and quarterly reports to the SEC, including the financial statements and the “Management’s Discussion and Analysis” portion of those reports, and recommending appropriate action to the Board. | |

| ● | Reviewing NETSOL’s audit plans. | |

| ● | Reviewing relationships between the independent registered public accounting firm and NETSOL; and, | |

| ● | Reviewing trends in accounting policy changes that are relevant to the Company. |

The Audit Committee has reviewed and discussed the consolidated financial statements with management and Borgers CPA. Management is responsible for the preparation, presentation and integrity of NETSOL’s financial statements; accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)). Borgers CPA is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States of America, as well as expressing an opinion on (i) management’s assessment of the effectiveness of internal control over financial reporting and (ii) the effectiveness of internal control over financial reporting.

| 20 |

The Audit Committee has discussed with Borgers CPA, the matters required to be discussed by Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and PCAOB Auditing Standard No. 2, “An Audit of Internal Control Over Financial Reporting Performed in Conjunction with an Audit of Financial Statements.”

Audit Committee Financial Expert.

The Company has identified its audit chairperson, Mr. Kausar Kazmi as its Audit Committee financial expert. Mr. Kazmi is an independent board member as the term is defined in the Nasdaq Listing Rules. Mr. Kazmi’s over 40 years of experience in the banking industry including his current tenure as Head of Commercial Banking and Business Development for UK and Europe for Habib Bank AG Zurich as well as his service as a board member on various charities as the board member responsible for fundraising, provides him with an understanding of generally accepted accounting principles and financial reporting. Additionally, this experience provides an ability to assess the general application of accounting principles in connection with the accounting for estimates, accruals and reserves; experience analyzing financial statements that were comparable in the breadth and complexity of issues that can be reasonably expected to be raised by the Company’s financial statements; an understanding of internal control over financial reporting; and an understanding of audit committee functions.

The Audit Committee of the Board of Directors has furnished the following report:

As noted in the Committee’s charter, NETSOL management is responsible for preparing the Company’s financial statements. The Company’s independent registered public accounting firm is responsible for auditing the financial statements. The activities of the committee are in no way designed to supersede or alter those traditional responsibilities. The Committee’s role does not provide any special assurances with regard to NETSOL’s financial statements, nor does it involve a professional evaluation of the quality of the audits performed by the independent registered public accounting firm.

The Committee has reviewed and discussed with management and the independent accounting firm, as appropriate, the audited financial statements.

The Committee has discussed with Borgers CPA, the required communications specified by auditing standards together with guidelines established by the SEC and the Sarbanes-Oxley Act.

The Committee has received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board, regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with Borgers CPA the firm’s independence.

Based on the review and discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements be included in the company’s report on Form 10-K for 2022 for filing with the SEC.

Kausar Kazmi, Chair

Mark Caton

Henry Tolentino

Nominating & Corporate Governance Committee.

The Nominating & Corporate Governance Committee is comprised of Messrs. Tolentino (Chair), Caton and Kazmi, as members, all of whom are independent within the meaning of the NASDAQ listing standards and Rule 10A-3(b) under the 34 Act. This Committee met virtually once during the 2022 fiscal year. The primary function of the Nominating Committee is to assist the Board in fulfilling its responsibilities with respect to Board and committee membership and shareholder proposals. Its primary duties and responsibilities are to: (i) establish criteria for Board and committee membership and recommend to the Board proposed nominees for election to the Board; and (ii) make recommendations regarding proposals and nominees for director submitted by shareholder of the Company.

| 21 |